NGI Archives | NGI All News Access | NGI The Weekly Gas Market Report

North America’s E&P Tech Capturing Most Global Investments

Exploration and production (E&P) technologies have attracted $7 billion in funding since 2003, with North American ventures accounting for the most investments by far, according to a new study.

In a 10-year span, North American E&P technology pulled in three-quarters (76%) of the total transactions at 377 and 87% of the investment dollars ($6 billion), Boston-based analysts with Lux Research found.

“Although the oil and gas industry has taken a conservative stance on emerging technology for decades, recent challenges in the upstream and midstream sector have initiated a wave of new opportunity for technology developers,” said Lux analysts Daniel Choi and Brent Giles, who authored the study. “The oil and gas industry gas now fosters innovation from both within and outside itself.”

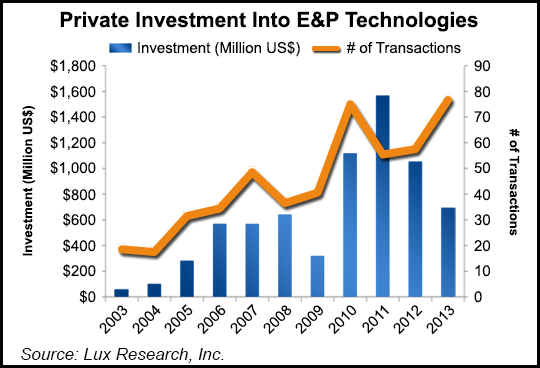

Investments in emerging E&P technologies “were nearly nonexistent in 2003 at just $57 million. Since then, E&P technologies have attracted nearly $7 billion in private investment from 497 unique transactions.”

The major oil and gas producers and operators, including big oilfield services companies, have internal groups charged with scouting for innovation, the analysts said. Industry-funded research and programs also drive innovation.

Two “waves” of outside innovation now flow into the E&P technology sector:

Novel ideas are “high-risk, high-reward investments,” such as Sunnyvale, CA-based Liquid Robotics Inc., which partnered with Schlumberger Ltd. (SLB) to develop the Wave Glider, an environmentally powered ocean-going platform to gather and transmit information about the surface of the ocean, such as water temperature, and the atmospheric conditions above, such as wind speed (see Daily GPI, June 25, 2012).

Enhancers often are “drop-in replacements,” adopted more quickly by the industry. An example is San Francisco-based Solazyme Inc.’s Encapso, a targeted friction inhibitor launched earlier this year. The on-demand lubricant delivery system claims to increase rates of penetration, decrease drag and reduce rotational torque and friction in vertical and horizontal drilling. An operator in the Anadarko Basin reported that drilling with a water-based mud using Encapso was better than using traditional oil-based muds and had reduced average torque by 40-60%, according to a case study.

The financial crisis curbed global E&P technology investments in 2009, but the industry bounced back with $1.6 billion in 2011, $866 million of which went to a single startup, Canada’s Laricina Energy Ltd., which focuses on oilsands technologies.

Megadeals dominated between 2010 and 2013, with large amounts of capital raised by companies that included Cambridge, MA-based GreatPoint Energy, which produces natural gas from coal, petroleum coke, and biomass utilizing its trademark bluegas catalytic hydromethanation process. Houston-based MicroSeismic Inc., which provides real-time monitoring and mapping of hydraulic fracture operations in unconventional oil and gas plays, also is among the companies that has attracted big investments, according to Lux.

“Within the E&P value chain, technologies that play in operations have found the most success in attracting investment, which is not surprising given the focus on improving production across all regions,” said Choi and Giles. “Technologies that enhance drilling and improve completions are also gaining interest and drive investment into the development sector.”

While operators invest to obtain early access to emerging technologies, “they will almost never acquire a technology company they invest in,” said the analysts. Many operating companies go public, but E&P tech developers rarely launch offerings.

“The most common exit strategy…is acquisition by oilfield services companies,” with SLB the most prolific buyer. SLB has acquired 56 E&P technology developers since 2003, according to Lux.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |