Tres Palacios Storage Sale Boosts Capacity Utilization

Crestwood Midstream Partners LP and an affiliate of Brookfield Infrastructure Group are acquiring Tres Palacios Gas Storage LLC from Crestwood Equity Partners LP for $130 million in cash. Crestwood Midstream will own 50.01% and operate the assets.

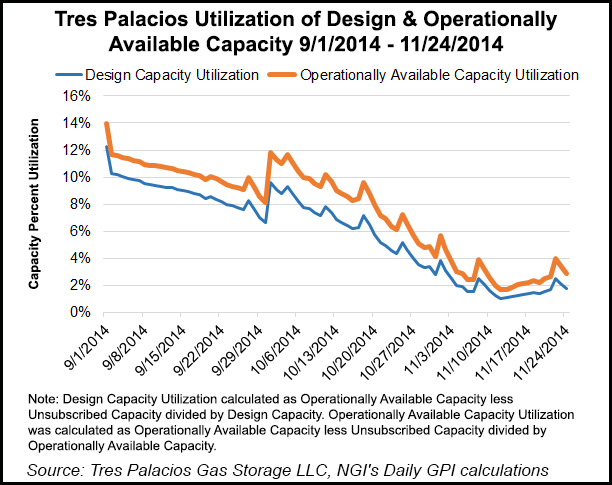

“Tres Palacios will immediately benefit as a result of the new long-term contract with Brookfield Infrastructure that will substantially increase the utilization of its available storage capacity,” said Robert Phillips, CEO of Crestwood’s general partners.

“In addition, the strong financial resources from the Crestwood Midstream and Brookfield Infrastructure joint venture significantly enhances Tres Palacios’ ability to participate in future expansion opportunities along the Texas Gulf Coast region to serve anticipated natural gas demand growth associated with LNG [liquefied natural gas] export facilities, exports to Mexico, and local power generation and industrial markets.”

Tres Palacios, located in in Matagorda, Wharton, and Colorado Counties, TX, has capacity to store up to 38.4 Bcf and provides more than 1 Bcf/d of injection and withdrawal capability. The facility has a 60-mile bidirectional pipeline system with 10 pipeline interconnects and associated facilities.

The new joint venture will not impact Tres Palacios’ previously filed application with the FERC to reduce certificated working gas storage capacity, the company said. Tres Palacios said it expect a favorable ruling on the application by the Commission. The storage operator is seeking to abandon capacity it leases from Underground Services Markham LLC and Riverway Storage Holdings LLC, which are contesting the application at the Federal Energy Regulatory Commission (see Daily GPI, Feb. 21).

Brookfield is a global owner and operator of utilities, transportation and energy infrastructure assets. Its North American energy platform includes about 15,500 km of natural gas transmission pipelines and 300 Bcf of natural gas storage, including its recently announced acquisition of the Lodi Natural Gas Storage facility in California.

As a part of the transaction, Brookfield is entering into five-year, fixed-fee contracts with Tres Palacios for 15 Bcf of firm storage capacity and 150,000 Dth/d of enhanced interruptible wheeling services beginning November 2014. The contracts will provide Tres Palacios with incremental annual firm revenues of approximately $16 million per year.

The transaction is expected to close in early December 2014.

“This transaction is an important step in executing our strategy to establish Crestwood Equity as a pure-play general partner MLP [master limited partnership,” Phillips said. “With the sale of Tres Palacios to a Crestwood Midstream joint venture, Crestwood Equity will continue to benefit from cash flow growth of the underlying assets through its ownership of the incentive distribution rights of Crestwood Midstream. In addition, the transaction will enable Crestwood Equity to reduce debt and improve its distribution coverage and leverage ratios, and to further diversify Crestwood Midstream’s portfolio of shale-based midstream assets with long-term fee-based contracts.”

Gulf Coast storage operators have seen the value of their capacity plummet in the shale era as natural gas price volatility has been diminished. Last week, Boardwalk Pipeline Partners LP filed an application to abandon some of its Gulf Coast gas storage for conversion to natural gas liquids storage (see Daily GPI, Nov. 18).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |