Utica Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Indications Utica Shale Interest Growing in North-Central Pennsylvania

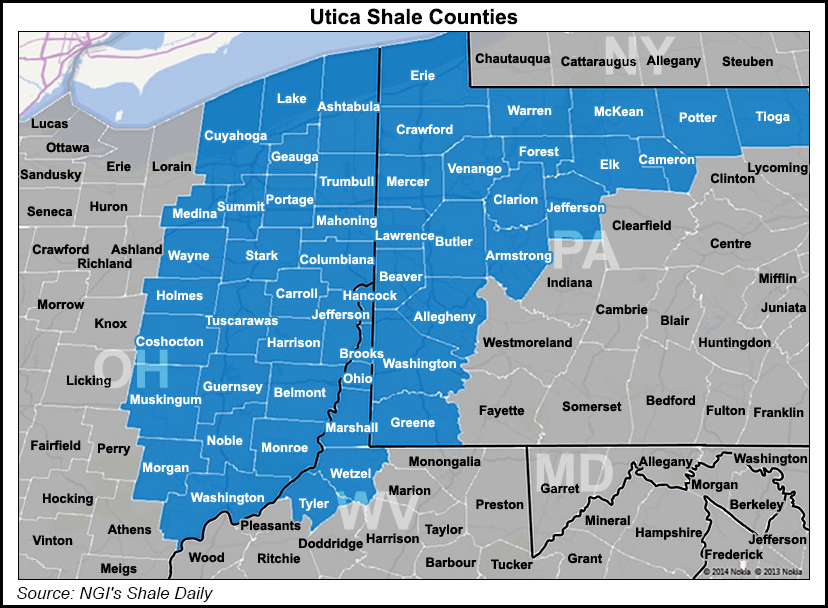

Two Utica Shale discovery wells drilled by Royal Dutch Shell plc in north-central Pennsylvania have piqued interest in the formation’s potential in a part of the Appalachian Basin that’s more than 100 miles northeast of the nearest horizontal Utica operator and more than 300 from the play’s sweet spot in eastern Ohio.

The formation drops considerably to the east of where it’s currently being developed in Ohio, and just a few months prior to Shell’s announcement — as operators were striking out to test the play’s boundaries in northern West Virginia and southwest Pennsylvania — sources indicated that wells as far east as Shell’s were things of the future (see Shale Daily, June 5; March 26).

“You add hundreds of meters below the Marcellus out there,” said Pennsylvania State University geosciences professor Terry Engelder. “I don’t have the exact figures, I’d have to look it up, but the Utica is Ordovician, it could be as much as 3,000 to 5,000 feet deeper than the Marcellus there.”

In September, Shell said its Neal and Gee wells, located in Tioga County, were drilled to a total depth of 14,500 and 15,500 feet, respectively (see Shale Daily, Sept. 3). The Gee well had an initial flowback rate of 11.2 MMcf/d, while the Neal, put online last February, had a peak flow rate of 26.5 MMcf/d. The company said at the time that the wells “extend the sweet spot of the Utica formation beyond southeast Ohio and western Pennsylvania, where previous discoveries have been located, and into an area where Shell holds a major leasehold position of approximately 430,000 acres.”

Engelder said, however, that little is generally known about the Utica’s mechanics that far east and how exactly it responds to unconventional drilling techniques.

“We don’t understand that much about what’s happening with the Utica as you go farther east,” he said. “I think it’s reasonable to say we were pleasantly surprised by the Shell wells. That’s in an area where the Trenton-Black River formation was being produced. That section of the Utica that sits between Tioga County and Ohio is a bit of a mystery.”

The Gee well had been on production for nearly one year prior to Shell’s announcement. The company’s position in north-central Pennsylvania was bolstered a month before it released those test results in a deal with Ultra Petroleum Corp. that found Shell exiting the Pinedale Anticline in Wyoming in exchange for 155,000 net Marcellus/Utica acres in Tioga County and nearby Potter County (see Shale Daily, Aug. 14). Matt Henderson, a shale gas asset manager at Pennsylvania State University’s Marcellus Center for Outreach and Research (MCOR) said that deal, coupled with Shell’s Utica results, helped attract attention to the Utica’s prospects in that part of the state.

“There’s definitely renewed interest from operators in that area,” Henderson said. He added that land prices have steadily been on the rise, where parcels are being acquired in Tioga and Potter counties — long hotbeds for Marcellus activity — at about $1,500 acre. But Shell is not the only company that has, or plans to tinker with the formation in north-central Pennsylvania. Last year, in nearby McKean County, PA, Seneca Resources Corp. tested a Utica well at a peak rate of 8.5 MMcf/d.

Henderson, who declined to provide specifics, said one operator in the area recently attempted to drill the Utica Shale, but after encountering extremely high formation pressures, was forced to stop operations and reconsider its plans. “It’s just a different animal in that part of the state, you know, they have to figure out still how to crack the code.”

A massive formation that extends from Quebec along the St. Lawrence River Valley into the lower 48 states, over to Michigan in the west and as far south as Tennessee, the Utica Shale has primarily been developed by horizontal drilling in Ohio. In Pennsylvania, there were just 28 unconventional Utica wells active during the first six months of this year, according to state data (see Shale Daily, Sept. 19). Those wells reported producing 7.2 MMcf of natural gas, 18,336 bbl of condensate and 4,695 bbl of oil.

Seneca, which has a number of Utica wells in northwest Pennsylvania, where such development is now common, could not be reached to comment about other plans it might have for the Utica in the east. A number of other companies in the basin have been pressing the play’s boundaries in West Virginia and Pennsylvania, including EQT Corp., which has plans for its first Utica Shale well in southwest Pennsylvania’s Greene County (see Shale Daily, July 24).

Prior to the basin’s unconventional boom, the Trenton-Black River formation, which lies below the Utica, was a dominant gas target for vertical wells in places such as New York. Operators, though, could be growing more knowledgeable about the Utica in the east, Engelder said.

“There could be others that have done some work with seismic for example,” he said. “We really don’t know who else has drilled through the Utica in that area. I’m not sure what the data set is; it’s proprietary.

EQT, along with other leading operators in the basin, has a significant acreage position in Tioga County. Company spokeswoman Linda Robertson said that while EQT has not engaged in any proprietary seismic testing of its own in the area, it does have access to third party seismic data, which she said indicates the Utica could be prospective in the area.

“Based on any success we see from our well in southwest Pennsylvania, we’ll continue to evaluate all our acreage in Tioga County, and our dry Utica development could potentially increase,” Robertson said.

Tioga County Recorder Jane Wetherbee told NGI’s Shale Daily that rumors about interest in the area’s Utica Shale seem to be growing. She noted, however, that leasing activity never really dropped off in the region.

“We have seen more of the searchers lately,” she said, referring to more landmen in her office. “They do rotate every so often anyway, and I believe it’s mainly because many of the leases have met their five or ten year span.” When asked, she said it’s not just one or two companies visiting the Recorder of Deeds office lately, but several.

To be sure, sources agreed it remains unclear where capital budgets will be next year, with depressed oil prices appearing to put downward pressure on spending plans. And although gassier exploration and production companies are expected to outperform over the winter months on colder than normal temperatures, medium-term prices through the spring could also restrain their appetite for risk.

But Engelder said when the wells are drilled and if “they are as big as Shell indicated,” then it’s only a matter of time before more Utica development gets underway in north-central Pennsylvania.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |