Encana Secures More Duvernay Rich Gas Processing with Aux Sable

Aux Sable Canada LP has clinched its second agreement this year with Encana Corp. to process rich natural gas from the Duvernay Shale.

The rich gas premium (RGP) agreements with Encana and joint venture partner Brion Duvernay Gas Partnership provide for processing up to 180 MMcf/d and connecting to a receipt zone with Alliance Pipeline in Alberta from November 2017 through 2020.

“This agreement with Aux Sable supports our development plans in the Duvernay resource play while diversifying Encana’s pricing exposure,” said Encana Executive Vice President Renee Zemljak, who is in charge of Midstream, Marketing & Fundamentals. The Duvernay is one of the “key growth areas” in the company’s portfolio.

In March, Aux Sable secured a five-year agreement with Encana and Brion, formerly Phoenix Duvernay Gas, to process up to 195 MMcf/d over five years beginning last July through 2020 (see Shale Daily, May 13). The gas would be transported via Alliance to Aux Sable’s plant in Channahon, IL.

At the end of September, Encana had five rigs operating in the Duverney with 19 net wells drilled (see Shale Daily, Nov. 12). Developing long-term takeaway capacity is considered a priority for the gas-rich play. Encana commissioned the 15-31 compressor plant in the third quarter, which is expected to increase processing capacity to 55 MMcf/d of gas and 10,000 b/d of condensate.

“We continue to receive overwhelming support for our RGP agreements from liquids-rich gas producers in Canada and the U.S. seeking the best value for their products,” said Au Sable Canada CEO Tim Stauft. “Our facilities are strategically located to provide liquids-rich gas producers with access to competitive natural gas and natural gas liquids markets. This transaction strengthens our feedstock supply beyond 2015 and further underpins our growth strategy.”

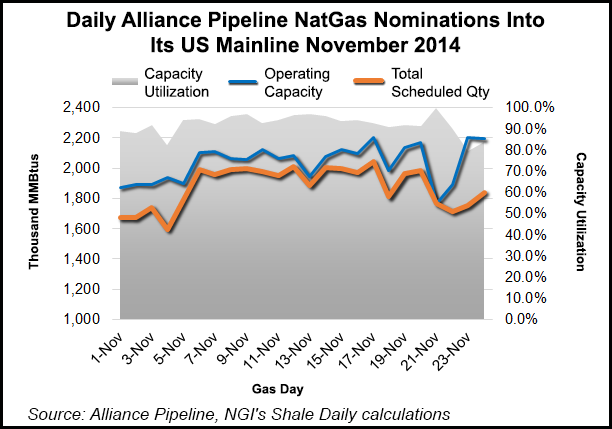

Aux Sable Canada’s U.S. affiliate Aux Sable Liquid Products LP in November said it would spend $130 million to expand processing at the Channahon facilities (see Shale Daily, Nov. 4). The planned expansion, scheduled to be completed in mid-2016, would increase the fractionation capacity by 24,500 b/d. It also would expand the liquids production capacity to 131,500 b/d. Since starting up at the same time as Alliance, the Aux Sable site has processed 2 Tcf and pumped 12 billion gallons of liquids byproducts (see Daily GPI, May 23). Canada exports fill most of the capacity for 2.1 Bcf/d and 107,000 b/d of liquids.

Calgary-based Aux Sable Canada is owned by Enbridge Inc. and Veresen Inc. The U.S. affiliate is owned by Enbridge, Veresen and Williams Partners LP.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |