December Weather Key to Natural Gas Basis Market Direction

Natural gas forwards markets appeared to be taking a breather this week, with most market hubs shifting less than a nickel from Monday to Wednesday, amid some see-sawing in Nymex futures and uncertainty in long-range weather forecasts.

The lone exception was Algonquin Gas Transmission citygates, which continued last week’s sell-off as a return to more seasonal temperatures is forecast for the region.

“The weather pattern to start December will bring a series of milder weather systems with near-normal temperatures,” forecasters with NatGasWeather said Thursday. “Although, there will remain dangerously cold air just across the border, and if at any time it looks like the Pacific jet stream will relax or not come in quite strong enough, Arctic air will have opportunity to advance into the U.S.”

Still, a Northeast trader said it it would be difficult for prices to sustain their current levels.

“The weather is not locked in. We warm up, then it’s cold again. That isn’t enough to sustain record prices this early,” the trader said, adding that prices would likely crash in the absence of more sustained cold.

Algonquin December basis plunged 68 cents between Monday and Wednesday to reach plus $9.817/MMBtu, according to NGI’s Forward Look. January dropped a far more substantial $1.872 to plus $13.928/MMBtu, while the January-March package fell $1 to $11.645/MMBtu.

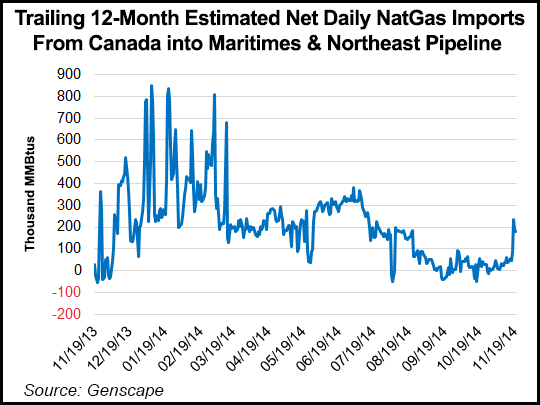

The losses at Algonquin occurred despite word from Encana that maintenance at the Deep Panuke offshore facility that began in late September would continue into early December. The repairs were needed after higher-than-expected levels of water were produced, and Encana has said that once the facility is back online, production would likely be limited to 140,000-180,000 Mcf/d, a decline of about 70,000 Mcf/d from pre-maintenance levels.

Meanwhile, packages further out Algonquin’s forward curve hardly budged as the volatility in the Nymex resulted in only small changes for the week. The Nymex December contract climbed just 3 cents between Monday and Wednesday and was trading lower Thursday despite a larger-than-expected withdrawal from storage.

“The natural gas market is clearly comfortable with current storage levels for the upcoming winter heating season given the continued growth in the Marcellus and associated gas production,” said analysts with BMO Capital. “We believe natural gas prices are likely to drift until winter weather arrives.”

Elsewhere in the Northeast, Texas Eastern Transmission zone M3 December basis fell 8 cents between Monday and Wednesday to reach plus 42.7 cents/MMBtu, while January dropped 13.4 cents to plus $3.09/MMBtu. The balance-of-winter strip (January-March) was flat at plus $1.58/MMBtu, while the summer 2015 package slipped 3 cents to minus $1.163/MMBtu. Further out the curve, TETCO M3’s winter 2015-2016 strip lost a couple of cents to hit plus 62 cents/MMBtu.

Transcontinental Gas Pipeline zone 6-New York followed a similar path as December dropped about 8 cents to reach $2.997/MMBtu, the balance of winter fell 3.8 cents to $5.213/MMBtu and the summer 2015 slid 3 cents to minus $1.013/MMBtu.

“Demand’s easing as temperatures warm,” said Genscape’s Rick Margolin, senior natural gas analyst. “…[L]ots of uncertainty in the longer-range forecasts, and things are still colder than normal. But that’ll break as the week progresses.”

The decline in prices comes even as the cold weather took a hit on regional production, resulting in about 0.2 Bcf/d of lost supply in the past couple of days, Margolin said.

“We believe the worst is over, and production volumes will start coming back beginning Wednesday for Thursday,” Margolin said, adding that about 0.4 Bcf/d in supplies from the Markwest Sherwood plants in West Virginia that had been cut off the past two days due to maintenance should also return Thursday.

Prices in Appalachia also softened amid ongoing rampant production. Dominion December basis tumbled 15.4 cents to minus $1.228/MMBtu, while the balance of winter came off 12 cents to minus $1.19/MMBtu. Summer 2015 slipped just 2 cents to minus $1.341/MMBtu.

Elsewhere in the U.S., Midwest markets found some strength amid spiking cash prices due to the recent cold snaps. Chicago citygates cash jumped 28 cents between Monday and Wednesday, averaging $5.05/MMBtu for Thursday’s gas delivery.

In forward basis trading, Chicago citygates December climbed nearly 10 cents between Monday and Wednesday to reach plus 59.5 cents/MMBtu, while the balance of winter picked up 7.6 cents to reach plus 57.2 cents/MMBtu. Chicago’s summer 2015 strip was essentially flat at minus 1 cent/MMBtu.

Michigan Consolidated Gas posted similar gains.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |