NGI Archives | NGI All News Access | NGI The Weekly Gas Market Report

MLP Metamorphosis Bodes Well For Raising Capital

Maturation of the midstream master limited partnership (MLP) sector has coincided with the shale natural gas/oil-driven infrastructure buildout boom in a way that should give developers confidence that the billions in capital they need to get projects in the ground will be available, a Goldman Sachs managing director told a Houston audience Tuesday.

Institutional public equity investors, such as large mutual funds and others with deep pockets, have embraced the sector; they are willing and able to pony up the tens of billions in capital expenditures (capex) needed to construct gas, oil and natural gas liquids pipelines and processing infrastructure, Goldman’s Will Bousquette said at the 2014 Deloitte Oil & Gas Conference.

“Financing the capex that the operators are coming up with is possible because we’re attracting enormous amounts of institutional capital,” he said. “We’re attracting enormous amounts of institutional capital because there are more businesses; they’re growing more rapidly, and those are the hallmarks of the kinds of things you want in a sector to attract large amounts of equity capital to support growth plans…”

Five years ago, there were about half as many MLPs as today’s 126, he said. The sector’s market capitalization was around $100 billion then, with $55-60 billion of that spread among just five MLPs. The remaining players were worth less than $1 billion each — too small for institutional investors to bother with. Today, the sector is worth $600-700 billion. “The size of the entities has become very very large,” Bousquette said.

The largest MLP five years ago had a market capitalization of about $16 billion, he said. Today, the largest MLP on the Alerian MLP Index is Enterprise Products Partners LP with a market capitalization of more than $72.1 billion. No. 2, Kinder Morgan Energy Partners LP, which is in the process of turning into a C-corp. (see Daily GPI, Aug. 11), is worth $32.9 billion. Energy Transfer Partners LP is third with an estimated value of $23.2 billion.

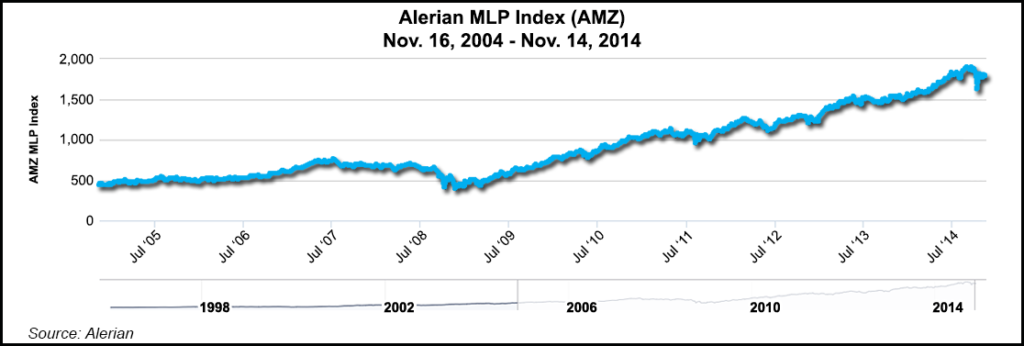

The number and diversity of MLPs seen today was one thing that was needed to draw institutional investors to the table, Bousquette said. And companies needed to be big enough to absorb large investments and provide the returns demanded by institutions. Performance was another requirement; it doesn’t hurt that the Alerian Index has outperformed the broader stock market. Choice, liquidity and long-term out-performance bring in the big capital, Bousquette said.

Historically, retail investors have turned to MLPs as an alternative to bonds. They’re being outnumbered by institutions now. Bousquette said he gets queried about MLP valuations these days and whether there might be an MLP bubble. “I’ll be honest, I was worried when the butcher at a grocery store asked me about the price of an MLP the other day,” he said.

“The key thing to understand is it’s not that the valuation has changed; it’s that the companies and the people who operate them have transformed them into growth entities. The real story of the change in midstream and MLP valuations is not a 1999-2000 telecom investment bubble; it’s that the businesses are growing faster,” he said.

Comparing today’s lower MLP yields with those of past years is not an apples-to-apples comparison because today’s entities are experiencing much faster growth. “…[T]he number of companies that are growing has meaningfully changed, and their growth profile is changed. And so this is why public equity is being attracted in such record amounts and why we’re able to finance so much capex.”

Institutional investors couldn’t always invest in MLPs and have only been able to do so for the last decade, said NGI’s Patrick Rau, director of strategy and research. Rau is a former sell-side equity research analyst who covered the MLP sector.

“The American Jobs Creation Act of 2004, of all things, reclassified the distributions paid by master limited partnerships as a ‘qualified’ form of income, which meant that MLPs could then be held by institutional investors. But it still took a while for institutional investors to feel comfortable holding MLP units since MLPs report their financial results a bit differently from regular C-Corps. For MLPs, it’s all about distributable income rather than traditional earnings per share.

“Moreover, MLPs are more complicated from a tax filing standpoint, so that probably scared off some larger institutional investors back in the day as well.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |