NGI Archives | NGI All News Access

Execs Bullish on Oil/Gas Supply; Regulations a Concern

Optimism among energy patch executives has been growing, according to a recent survey. However, oil price declines, a fracking ban in a small Texas town and the Republican sweep of midterm elections could make for some turmoil in the months ahead.

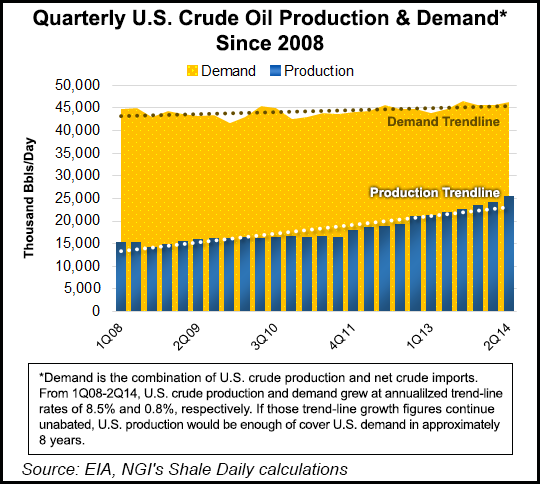

The United States has plenty of natural gas to meet the demand to come, and thanks to shales, the country will be self-sufficient in oil within five to 10 years, according to industry executives recently polled by consulting firm Deloitte. The survey was conducted just before the oil price decline; Denton, TX, fracking ban; and midterm elections (see Shale Daily, Nov. 5a; Nov. 5b; Daily GPI, Nov. 5a).

The “2014 Oil & Gas Survey: The Next Chapter of the Energy Renaissance” found that there has been a 150% increase in the number of those polled who think the country is or will be self-sufficient in oil within the next five years (20%) compared to the 2012 survey.

The vast majority (90%) of respondents believe the U.S. now has enough affordable domestic natural gas production to meet rising and changing sources of demand, Deloitte said. The rosy production outlook may have contributed to a general sense of industry optimism, with 80% of respondents believing the U.S. energy situation has improved, versus five years ago, and is headed in the right direction.

“The recent shake-ups in prices, politics and regulations provide a compelling backdrop to evaluate the responses provided in the survey; as the industry tests the waters with respect to shale’s resilience during a cycle of low prices, only 15% of respondents at the time expressed that they were very or extremely concerned about a possible price collapse,” said Deloitte’s John England, U.S. oil and gas leader. “The industry is watching politics and prices closely, especially when it comes to exports — an issue seen as crucial for continued success, with 83% of respondents indicating that exports are important for the long-term viability of unconventional oil and gas production in the U.S. [see Daily GPI, Nov. 5b].”

Additional concerns weighing on the minds of industry executives responding to the survey were related to costs. Those who believed oil and gas capital spending would rise remained fairly constant, with more than half (56%) expecting more capital spending in 2015.

Expectations for mergers and acquisitions (M&A) activity showed that half of the respondents expect an increase in M&A activity over the next year. As it pertains to downstream, over 80% of the respondents believe that profitability will strengthen or remain the same, even as the industry continues to deliver very strong results.

“The survey revealed continued positive momentum regarding the optimization of U.S. shale,” England said. “Shale development remains the lynchpin of the North American energy renaissance, and improving extraction technologies and methods as well as improved midstream infrastructure are fueling the growth of production.”

Sixty-six percent of respondents believe that technological advancements in shale extraction have improved the economics of shale. Nearly half (44%) point to the smaller environmental footprint of shale as a significant improvement, while 39% believe fresh water recycling has improved, according to Deloitte.

Despite growing optimism over shale innovation, potential federal regulation was the greatest concern among respondents (65%) — nearly double the next greatest concern, which was cost margins (38%).

“In fact, 48% of respondents were ‘very’ or ‘extremely’ concerned about new EPA [Environmental Protection Agency] regulations that could negatively impact the economics of shale, and this concern may continue to grow in a low-price environment,” Deloitte said. “The responses indicate that regulations once established and known by the industry can be easily incorporated into standard operating procedures; however regulatory uncertainty can interfere with the ability of industry to plan and can potentially prevent new projects from moving forward.”

However, with Republicans doing so well in the midterm elections, the pace of regulatory changes could be slowed, the firm said.

“At the surface, Republican control of the legislative agenda would appear to amplify the sense of industry optimism, but there remain ample opportunities for continued gridlock since [the] GOP’s margin of victory in the Senate does not leave them with a large enough majority to avert the threat of a Democratic filibuster that can keep legislation locked in procedural limbo,” England said.

Although most respondents believe the Mexican energy reform will primarily benefit super-majors and large independents, 39% believe opening Mexico will strengthen U.S. competitiveness. Two-thirds of respondents believe that the liberalization of Mexico’s oil and gas industry is at least somewhat critical to help North America achieve energy self-sufficiency.

“Whereas many in the industry have been focused on the oil and natural gas production onshore and offshore Mexico, one under-reported huge opportunity is in the buildout of midstream infrastructure [see Daily GPI, Sept. 29], which is a good opportunity in the short term, but exploration and production is a much larger opportunity in the longer term,” said Jorge Castilla, a partner at Deloitte Consulting Mexico LLP.

“Additionally, U.S. natural gas production for the electrification of half of Mexico, which right now relies on oil-based products is another area of strategic consideration [see Daily GPI, Nov. 17; Nov. 7]. From a capital spending and environmental perspective, this demand-side opportunity is arguably as large, or even larger, than the upstream potential.”

Deloitte conducted the survey in late October and canvassed more than 250 oil and gas professionals from a decision-making demographic: respondents were 48 years old on average and had an average of 20 years of experience in the industry.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |