Bakken Shale | E&P | NGI All News Access

North Dakota Production Soars as Prices Drop and More Regulation Looms

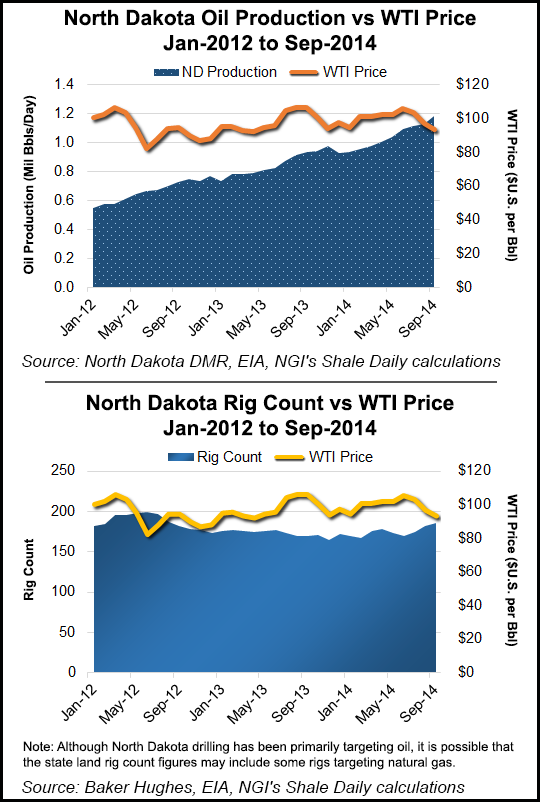

The juggernaut that is the North Dakota oil and natural gas production keeps hitting all-time highs as oil prices and rig counts continue to plunge, and added state and federal regulations loom large.

That was the picture painted Friday by the state’s chief oil/gas regulator, Lynn Helms, director of the Department of Mineral Resources, in releasing the most recent production statistics for September.

While Helms does not think prices will get low enough on a sustained basis to trigger a state oil extraction tax exemption, he does think rig counts will continue to go down and that a combination of new rules for regulating Bakken oil content and other factors will make it difficult to meet the Jan. 1, 2015 goal for cutting flaring statewide to 23%.

“I haven’t talked to anyone who has a good sense of where the [price] bottom is on this crude oil market,” Helms said. “We’re dealing with near-term record lows in price, a significant drop in rig count, but record oil/gas production.”

Well completions were down significantly in September from the previous month (from 272 in August to 176), and Helms attributed the drop to the emphasize on gas capture plans (see Shale Daily, Sept. 17) causing many operators to delay completing well that have no means of capturing most of the associated natural gas for lack of pipeline connections and processing capacity.

Oil production jumped up by 52,000 b/d in September, hitting 35.5 million bbl (1.18 million b/d), compared to 35 million bbl (1.13 million b/d) in August. For natural gas, production hit 42.1 Bcf (1.4 Bcf/d) in September, compared to 41.7 Bcf (1.3 Bcf/d) the previous month. Producing wells also hit an all-time high at 11,741 in September.

As Helms briefed news media he said the rig count was down to 186, compared to 191 in October and 195 in September. He noted that there is no longer a direct connection between production and the number of rigs operating because in the Bakken/Three Forks play operators are concentrating more on core wellsites delivering the high production/well.

“They’re drilling 3,000 b/d core area wells instead of 300 b/d wells,” Helms said. “So there isn’t necessarily a direct tie between rig counts and oil production, although there is an overall connection.”

As for oil prices, Helms reported that Bakken crude has reached what he call “a modern low price” at $58.75/bbl as of Friday (the all-time high was $136.29/bbl on July 3, 2008), but he said the realized price for the supplies typically runs 5%-10% above the posted price on any given day.

“A significant number of barrels leave the state and don’t get the state-posted price, but may get closer to a Brent or WTI price,” said Helms citing the most recent realized price data in September showing the state’s posted price at $74.50/bbl, but the realized price was $80.30/bbl. “It’s an estimate. We don’t really know what everyone is getting paid,” he said.

The key for the state is the WTI trigger price used by the state tax officials. This year the trigger is $52.06/bbl, and it must stay at that level or lower for five consecutive months to trigger the state extraction tax exemption for producers. “I think it rises somewhere north of $55/bbl next year,” said Helms, citing the current WTI price at $77.18/bbl, so there is about a $25/bbl gap between it and the state’s trigger.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |