Markets | NGI All News Access | NGI The Weekly Gas Market Report

Halliburton, Baker to Combine in Gigantic Deal

Halliburton Co. (HAL) on Monday agreed to acquire Baker Hughes Inc. in a transaction worth an estimated $34.6 billion, bringing together the world’s No. 2 and No. 3 oilfield service (OFS) operators. On a pro-forma basis, the combined company had 2013 revenues of $51.8 billion, 136,000-plus employees and operations in more than 80 countries.

Under the terms of the agreement, each Baker share would be exchanged for 1.12 HAL shares, plus $19.00 in cash. The value of the merger represents a premium of 40.8% to the stock price of Baker on Oct. 10, the day prior to HAL’s initial offer. The merger is expected to be completed in the second half of 2015.

Regulatory talks with appropriate officials, as well as customers, were set to begin Monday, HAL CEO Dave Lesar said during a conference call. Lesar, who is to become CEO of the combined company, held a conference call with Baker CEO Martin Craighead and HAL CFO Mark McCollum.

The combination “will create a bellwether global oilfield services company and offer compelling benefits for the stockholders, customers and other stakeholders of Baker Hughes and Halliburton,” Lesar told analysts. “The transaction will combine the companies’ product and service capabilities to deliver an unsurpassed depth and breadth of solutions to our customers, creating a Houston-based global oilfield services champion, manufacturing and exporting technologies, and creating jobs and serving customers around the globe.”

The news did not enthuse HAL shareholders, who sent the stock price down more than 10% to end the day at $49.21 in heavy trading. Baker’s share price rose almost 9%, closing the day above $65.00.

During the conference call, Lesar attempted to impress upon investors and analysts that the combination would create a lot of synergies, estimated at around $2 billion a year. North American operations onshore in particular would become more efficient, he said. In some basins, Baker and Halliburton work “side by side,” he told analysts.

“The integration teams are moving rapidly…In particular in hydraulic fracturing, where we can combine our logistics networks.”

HAL stockholders, he said, “know our management team and know we live up to our commitments. We know how to create value, how to execute and how to integrate in order to make this combination successful…

“As such, we expect that the acquisition will be accretive to Halliburton’s cash flow by the end of the first year after closing and to earnings per share by the end of the second year. We anticipate that the combined company will also generate significant free cash flow, allowing for the return of substantial capital to stockholders.”

Craighead, whose management team’s place in the new organization was not detailed, said the combination would “create a new world of opportunities to advance the development of technologies for our customers. We envision a combined company capable of achieving opportunities that neither company would have realized as well — or as quickly — on its own, all while creating exciting new opportunities for employees…

“I see the potential to have the best oilfield services company that has ever existed, full stop,” said the Baker chief.

The merger is going to leverage complementary strengths to create a company “with an unsurpassed breadth and depth of products and services,” Lesar said. “The companies are highly complementary from the standpoint of product lines, global presence and cutting-edge technology in the worldwide oil and natural gas industry.”

There also would be “increased capabilities in the unconventional, deepwater and mature asset sectors, substantial and improved growth opportunities and continued high returns on capital.”

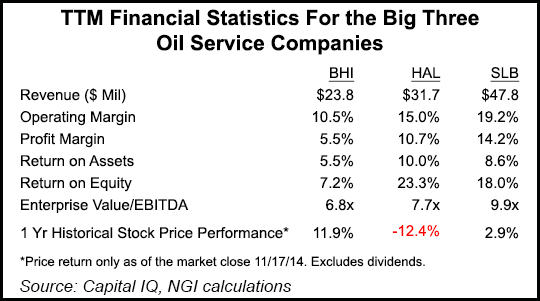

As they are configured today, the two companies would have a market cap of more than $70 billion, still far below that of No. 1 Schlumberger Ltd. (SLB) with an estimated $122 billion market cap. HAL and Baker overlap in at least half a dozen service areas. What HAL particularly likes, said Lesar, are Baker’s artificial lift technology and its drilling chemicals line.

The two companies together also would cast a big shadow on the North American pressure pumping market, and relieve HAL from its biggest competitor in the U.S. onshore.

HAL now has a 28% share of the North American pressure pumping business, while Baker holds 26% and SLB 14%. For hydraulic fracturing techniques, where water, chemicals and proppant are blasted into wells, HAL’s market share is around 26%, with Baker at 13% and SLB at around 20%. In the cementing/pumping business lines, HAL is the leader with 35% of the market, while Baker provides 16%, while SLB has 27%.

HAL’s capabilities would expand not only in the onshore, though, but also the “deepwater and mature asset sectors,” said Lesar, providing “substantial and improved growth opportunities and continued high returns on capital.” The combination is expected to yield annual cost synergies of nearly $2 billion.

HAL’s management team expects to see double-digit gains in operations and from other businesses that overlap. According to management, the amount of efficiencies are estimated at: 31% in North America operations; 23% international; 18% administrative/organizational; 11% research and development optimization; 9% corporate; and 8% real estate.

The merger, considered one of the largest ever in the OFS sector, would bring together legendary companies. HAL was founded in 1919 by Erie P. Halliburton in Duncan, OK as an oil well cementing business. Today the OFS specialist has headquarters in Houston, as well as Dubai, and is comprised of 13 product service lines that operate in two divisions: drilling/evaluation and completion/production. Pressure pumping and hydraulic fracturing are its big ticket items in North America.

Baker is known not only for its OFS prowess but also its highly anticipated weekly oil and gas rig counts. The company was formed in 1986 with the merger of century-old companies Baker International, founded by R.C. Baker, and Hughes Tool Co., founded in 1909 by Howard Hughes Sr., who patented a roller bit for rotary drilling. Legendary Howard Hughes Jr. took over the Houston company at the age of 19. The firm has nine regional and 23 geomarket management teams that cover U.S. Land, Gulf of Mexico, Canada, Latin America, Europe, Africa, Russia Caspian, Middle East and Asia Pacific.

To address antitrust concerns, a legal team from Baker Botts LLP already is advising management, Lesar said. The regulatory process needs to “play out,” but HAL already has agreed to sell businesses that generate up to $7.5 billion in revenues, if required by regulators.

“We’ve identified a number of potential buyers we believe will be very interested in the businesses that may need to be divested and expect that those businesses should all take excellent prices in expedited sales,” McCollum said. “We’re confident that a transaction is achievable from a regulatory standpoint.”

The company also agreed to pay a hefty $3.5 billion termination fee to Baker if the transaction fails to obtain required antitrust approvals. Executives sounded confident that the combination would be achievable from a regulatory standpoint.

U.S. antitrust entities of the Department of Justice (DOJ) and the Federal Trade Commission (FTC) “perform what is called a Hirfendahl Hirshmann Index (HHI) test to determine how competitive markets are,” notedNGI’s Patrick Rau, director of strategy and research.

“The HHI test takes the square of the market share of all firms in an industry, adds them up, and compares them to the number 1,500,” noted Rau. “Anything between 1,500-2,500 is considered to be ”moderately concentrated,’ and anything above 2,500 is considered to be ”highly concentrated’…

“If Baker and HAL were to merge as is, they would have a combined market share of 54%. Just those two firms combined would have an HHI of 2,916, which is a highly concentrated industry…The point is, I don’t see how the DOJ/FTC allows this merger without requiring these guys to divest some of their pressure pumping equipment.

“But I’d also have to think one of the reasons they are looking to merge is to give them some more control over what they are able to charge for their pressure pumping services, so they are only going to want to divest so much. What Washington decides on this is going to go a long way in determining how and perhaps even whether this merger goes down.”

The massive workforce is expected to be reduced, particularly where there is overlap. In the Houston area alone, the combined workforce as it would stand today would be close to 15,000 people.

Lesar and Craighead sidestepped questions concerning job layoffs. However, Lesar said HAL had planned to hire 21,000 employees this year to fill necessary positions.

The acquisition is to be financed with cash and debt. In additional to regulatory approvals, each company’s stockholders has to approve the transaction. Once completed, the combined board would expand to 15 members, three of whom would be from Baker.

Tudor, Pickering, Holt & Co.’s Jeff Tillery and Byron Pope noted that “this dance has been going on for a long time.” In correspondence that Craighead disclosed between the two companies late Friday, there was “an interesting tidbit about the confidentiality agreement signed by the two companies in 2005,” so the deal “is far from being a new courtship. Looking back at our own writings, the rumor mill ramped up the volume enough several times in 2006 and 2007 that we addressed it in morning note comments.”

Lesar also addressed the supposed antagonism between HAL and Baker that escalated ahead of the announcement. “There is always a bit of theater when these things come together,” he told analysts.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |