Halliburton in Merger Talks with Baker Hughes

Baker Hughes Inc. affirmed it is in preliminary discussions with Halliburton Co. regarding a potential merger, a blockbuster prospect for North America’s onshore and offshore operators — and for Houston as well, where the oilfield giants are headquartered.

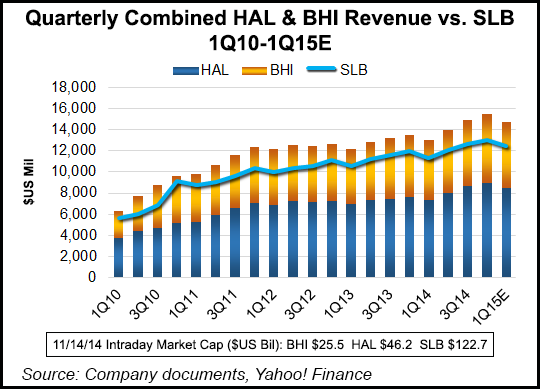

“These discussions may not lead to any transaction,” Baker, the No. 3 oilfield services (OFS) operator in the world noted. Halliburton (HAL), the No. 2 provider, said it would not comment further until it was appropriate. HAL and Baker are said to have been in talks for months, well ahead of the recent fall in crude oil prices, sources told NGI on Friday. Baker is being advised by, among others, Goldman Sachs, while HAL’s advisers included Credit Suisse. A merger could create an OFS firm with a $70 billion-plus market cap; Schlumberger Ltd. (SLB) still would hold its No. 1 spot with an estimated $122 billion market cap.

The combination would give HAL a leg up against SLB, wrote UBS analyst Mike Urban. SLB’s “distinct advantage” is global scale, leading to higher margins on more cost absorption and better efficiencies. A merger in the long run could give HAL “a significant advantage in gaining global share, expanding margins and competing against SLB,” Urban wrote. However, creating synergies between companies of that size could take two years or more because they are “very different and it would take time to become a unified company.” If it comes to pass, the combination would “create a company with over $55 billion in revenue, more than $70 billion in equity market cap and $80 billion in enterprise value,” based on Thursday’s stock prices.

“Upon completion, it would shift the market dynamic back in favor of the service industry, which has been facing a decline in market power in recent years as operators grew larger in relative terms and more recently in the face of declining oil prices,” Urban wrote. “It would also significantly narrow the gap between Baker/ HAL and long-time market leader SLB.”

Consolidation within the OFS sector has never slowed over the past few years, but there have been few blockbuster deals, none approaching the level of a Baker/HAL merger. SLB four years ago combined in an $11 billion merger with Smith International Inc. (see Daily GPI, Feb. 23, 2010). Baker in 2010 completed a $5.5 billion merger with BJ Services Co. (see Daily GPI, Sept. 1, 2009). Last year General Electric spent $3.3 billion to buy artificial lift specialist Lufkin Industries Inc. (see Daily GPI, April 9, 2013).

The North American market remains fragmented, with dozens of OFS operators providing one or more services to exploration and production companies. The Big Three often tout their expertise in providing full service amenities, giving them a distinct advantage in particular with deep-pocketed explorers able to buy package services over a contracted period.

Predicting the outcome of a completed merger is difficult, according to Tudor, Pickering, Holt & Co. (TPH). Jeff Tillery and Byron Pope in a note to clients Friday said mega-deals don’t happen on a “convenient” timeline, and they pointed out that it took five years for SLB to come to terms with Smith. SLB-Smith merger documents indicated that the companies actually began talks in 2005. It’s too soon to do more than back-of-the envelope estimates on a tie-up, said the TPH duo.

“Working in absence of any deal terms makes it hard to have a view as to whether a deal makes purely quantitative sense,” wrote Tillery and Pope. “A premium would obviously be involved, but it’s easy to turn the math into accretive depending on premium magnitude, whether a cash component is involved (both companies are lightly levered today), cost savings magnitude (huge overlap between the business)…”

Given the recent “crude price decimation,” accretion/dilution is “funny math at this point,” said the TPH team. They used the deals between SLB/Smith and Baker/BJ to take a stab at what a potential combination could mean. In both of those mergers, the cost savings of the acquired entities equaled about 15-20% of gross earnings or 3% of the annual revenues. In a HAL/Baker scenario, “that could mean potential cost saves of $750 million to $1 billion a year,” and “yes, this type of work is putting the cart WAY in front of the horse.”

There is a strategic rationale, including more international tenders, complementary projects, a global scale to rival SLB, but there are risks. In addition to anti-trust concerns, there’s also “execution from combining long-term fierce competitors,” said the TPH analysts.

HAL’s management team has said in recent quarterly conference calls that it would like to grow its production chemicals and artificial lift business, both organically and possibly through a merger/acquisition (M&A). With Baker, it would gain exposure in both areas, which combined are around 20% of Baker’s revenue mix.

Anti-trust issues also could be overcome, according to analysts. OFS M&A by rig equipment providers, production chemical providers and others “resulted in high apparent market shares, yet were able to be completed,” wrote Tillery and Pope. Still, it’s “an enormous question in how realistic and successful a…combination could be.” If there were too many required divestitures among their joint product services lines (PSL), it could water down the effectiveness of a potential merger.

North American pressure pumping activity could be the largest hurdle, “but we actually don’t think this should cause an anti-trust problem” among their PSLs. After “watching this business in recent years could compellingly argue that there would not still be competitive pressures in the business.”

The impact on Houston is a question, with sources telling NGI that workforce reductions likely would be a given. Baker employs a global workforce of around 61,000, with about half of its revenues from North America. HAL employs more than 80,000 people worldwide. There were no estimates available on how many each employ in the Houston area, where they not only are headquartered but where the major research and development activities are underway.

On Monday, HAL executives are scheduled to provide investors in New York City with an update of operations and a view of 2015.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |