Markets | NGI All News Access | NGI Data

NatGas Futures Hangin’ On Following Release of Larger-Than-Normal EIA Storage Stats

Natural gas futures managed to make it into positive territory following the release of government storage figures somewhat greater than what the market was anticipating.

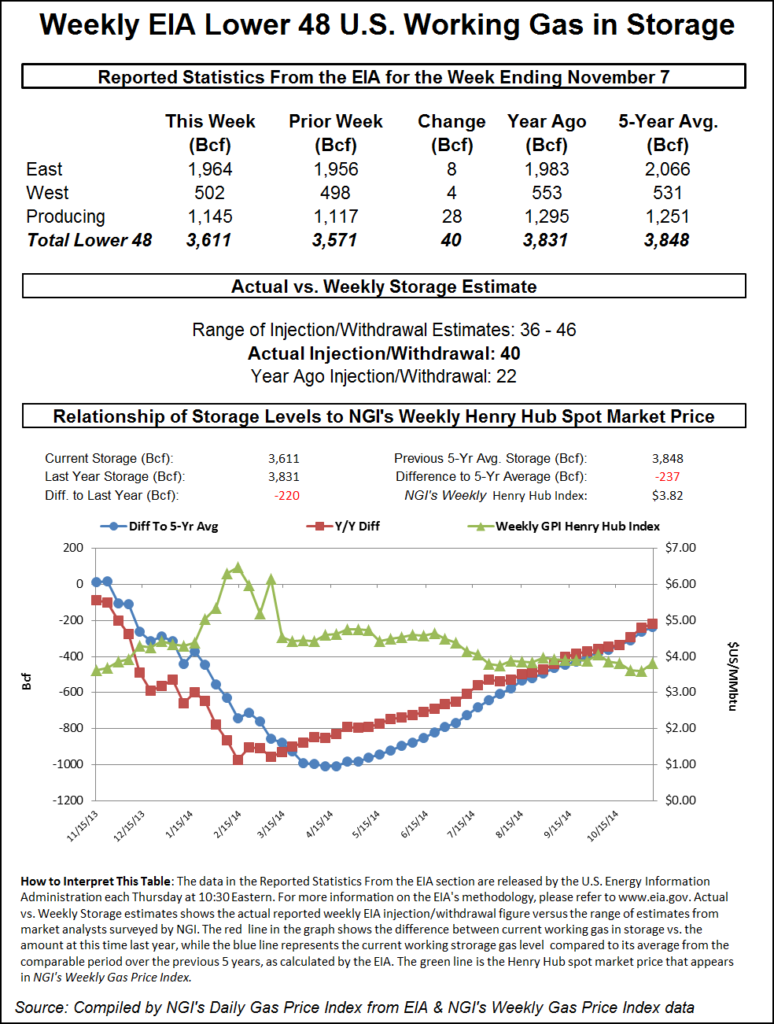

The injection of 40 Bcf reported by the Energy Information Administration (EIA) for the week ending Nov. 7 was about 2 Bcf more than market expectations, and much larger than historical comparisons. December futures had fallen to a low of $3.956 immediately after the number was released and by 10:45 EST the contract was trading at $3.983, up 0.6 cent from Wednesday’s settlement.

Prior to the release of the data, analysts were looking for an increase of about 38 Bcf. An analysis by United ICAP revealed an increase of 37 Bcf , and Citi Futures Perspective analysts calculated a 46 Bcf increase. Industry consultant Bentek Energy utilizing its flow model anticipated an injection of 38 Bcf.

“We were hearing anywhere from 36 Bcf to 38 Bcf, and the market came off a couple of cents,” said a New York floor trader. “I think we’ll trade below $3.95 today.”

“The 40 Bcf net injection was slightly above the consensus expectation, but certainly not outside of the range, a modest bearish surprise that won’t prompt any major overhaul to overall forecasts,” said Tim Evans of Citi Futures Perspective. “Attention will quickly return to the debate over whether the current cold snap is enough to support prices from current levels, given that more moderate readings will return by the last week of the month.”

Inventories now stand at 3,611 Bcf and are 220 Bcf less than last year and 237 Bcf below the 5-year average. In the East Region, 8 Bcf were injected and the West Region saw inventories increase by 4 Bcf. Stocks in the Producing Region rose by 28 Bcf.

The Producing region salt cavern storage figure added 13 Bcf from the previous week to 327 Bcf, while the non-salt cavern figure rose by 15 Bcf to 818 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |