NGI Archives | NGI All News Access

Exelon’s Growth Strategy Includes Diversification, New Technologies

Chicago-based Exelon Corp. on Thursday said it plans to continue to grow its power generation and utility businesses in the currently challenging energy market landscape through a strategy of targeted investments in core markets and promising technologies, and on asset diversification, with an eye on new technologies related to natural gas-fired power generation.

Speaking at the 49th Annual EEI Financial Conference in Dallas, TX, on Thursday, Exelon CEO Chris Crane said his company’s business model provides a platform to pursue a broad range of opportunities as changing consumer behavior, disruptive technologies, challenges to grid integrity and continued industry consolidation transform the industry.

“The changes sweeping our industry will impact existing markets and create new ones,” Crane said. “In this complex environment, our integrated business model is a distinct competitive advantage through which we will drive value for customers and shareholders.”

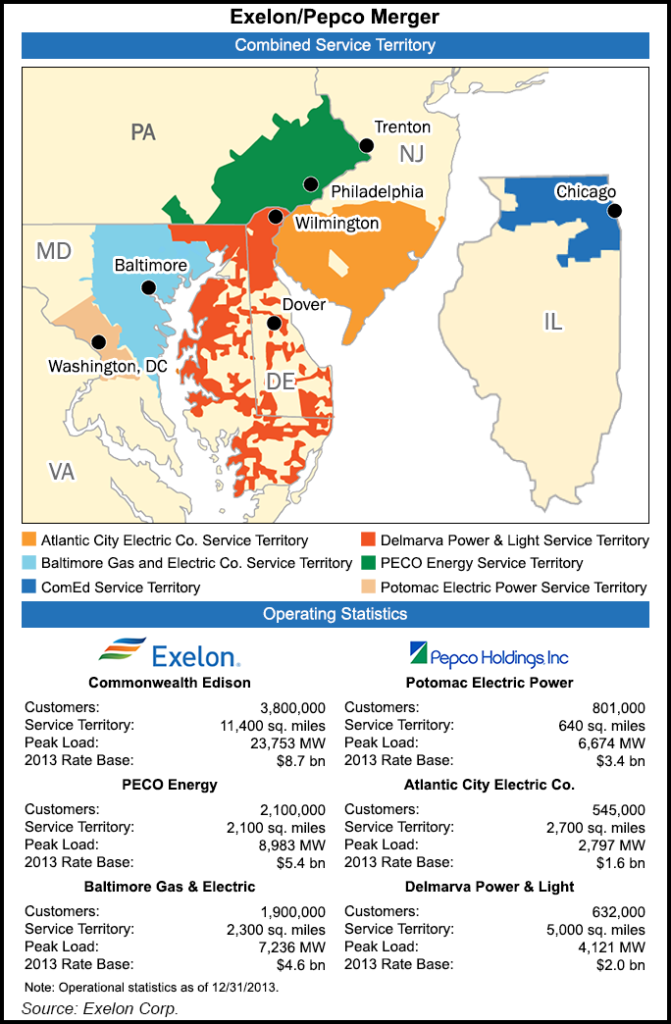

Exelon’s strategy is focused on preserving the value of its core assets, while also capitalizing on emerging trends and technologies to diversify the business where there are growth opportunities, Crane said. He added that Exelon’s proposed $6.8 billion merger with Pepco Holdings Inc. (PHI), which is expected to close mid-2015, is a prime example of the company’s plan to invest in core markets that offer stable growth (see Daily GPI,April 30).

The merger, which would create the top Mid-Atlantic electric and gas utility with close to 10 million customers, will combine Exelon’s three electric and gas utilities — Chicago’s Commonwealth Edison Co. (ComEd), Baltimore’s BGE and Philadelphia’s PECO — and PHI’s three electric and gas utilities — New Jersey’s Atlantic City Electric, Delaware’s Delmarva Power and Washington, DC and Maryland’s Pepco. The buyout is the first major transaction for Exelon since completing an $8 billion merger in 2012 with Constellation Energy (see Daily GPI, May 24, 2011).

To thrive in an industry undergoing fundamental change, Crane said Exelon has cultivated a culture of innovation that promotes early adoption of promising new technologies and processes. Examples include Exelon’s partnership with Bloom Energy to build fuel cell projects at 75 commercial facilities and its investment in NET Power, which is building a demonstration power plant using a new natural gas power system that produces zero atmospheric emissions. In addition, Exelon recently announced it is building two, first-of-their-kind combined-cycle gas turbine power plants in Texas that will be among the cleanest in the nation.

“Our integrated business model provides a strong foundation for success in an industry experiencing dramatic changes,” Crane said. “Diversification and innovation enable us to take advantage of a broad range of opportunities, rather than betting on any one segment of our industry.”

Between 2014 and 2018, Exelon said it will drive earnings growth by investing $16 billion in infrastructure and technology to improve reliability and customer service at its three utilities — BGE, ComEd and PECO.

Crane added that the company has invested heavily in its nuclear fleet over the past decade, making it the most reliable energy source in the PJM market. He added that the fleet is well positioned to benefit from new Environmental Protection Agency carbon regulations that will favor reliable, carbon-free energy.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |