E&P | NGI All News Access | NGI The Weekly Gas Market Report

EIA to Add 10 States to Monthly NatGas, Oil Production Reports

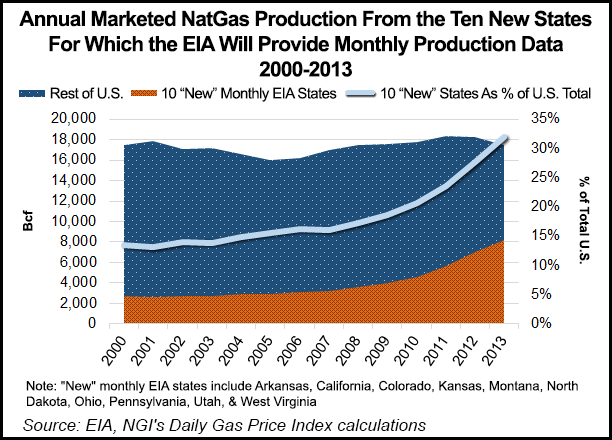

The U.S. Energy Information Administration (EIA) has received approval from the Office of Management and Budget (OMB) to add state-level data from 10 states, including some of the most shale-rich names in its current “Other States” category, to its monthly natural gas production survey.

Currently, EIA’s Monthly Natural Gas Production Report includes data collected from a sample of 240 well operators in five states and the federal offshore Gulf of Mexico, which represented, as of December 2013, 66% of total U.S. gross gas production, down from 82% in 2007 when the survey began.

In a notice published in the Federal Register earlier this year, EIA had proposed collecting state-level data from an additional 14 states, a change which the agency said would raise the sample coverage for natural gas production to 92% (see Daily GPI, May 6). OMB told EIA it could begin including breakout date for 10 of the proposed states.

“The additional states are Arkansas, California, Colorado, Kansas, Montana, North Dakota, Ohio, Pennsylvania, Utah and West Virginia,” an EIA spokesman told NGI. “That is, Alabama, Michigan, Mississippi and New York were not added and will remain embedded in ‘Other States.'”

In recent surveys, the Other States category, which currently includes several shale-rich states, has been the only one consistently able to record significant production increases (see Daily GPI, Nov. 3).

EIA also proposed to collect crude oil and lease condensate production data for the same 19 states and the federal offshore Gulf of Mexico. EIA currently publishes state-level crude oil production data based on information reported to state oil and gas agencies and, where state data are not immediately available, EIA estimates production.

“Long lags in state-level reporting have made it difficult to estimate oil production,” EIA said in its proposal. “Collecting data directly from well operators should provide more timely, consistent, routine and accurate production data.”

The agency said the rapid rise in production from tight formations makes identifying shifts in the qualities of crude oil and lease condensate production increasingly important. “Collecting information on the API gravity of crude oil and lease condensate, and possibly the sulfur content, will provide a clearer picture of those shifts,” EIA said.

The new surveys are expected to begin in January, with resulting data likely to be released beginning by mid-2015.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |