E&P | Bakken Shale | Eagle Ford Shale | Marcellus | NGI All News Access | Permian Basin | Utica Shale

Domestic NatGas, Oil Production to End 2014 on Steady Upswing, EIA Says

Production of natural gas and oil from the seven most prolific U.S. shale and tight oil regions will continue to increase through the end of the year, reaching 44.12 Bcf/d and 5.26 b/d in December, according to the Energy Information Administration (EIA).

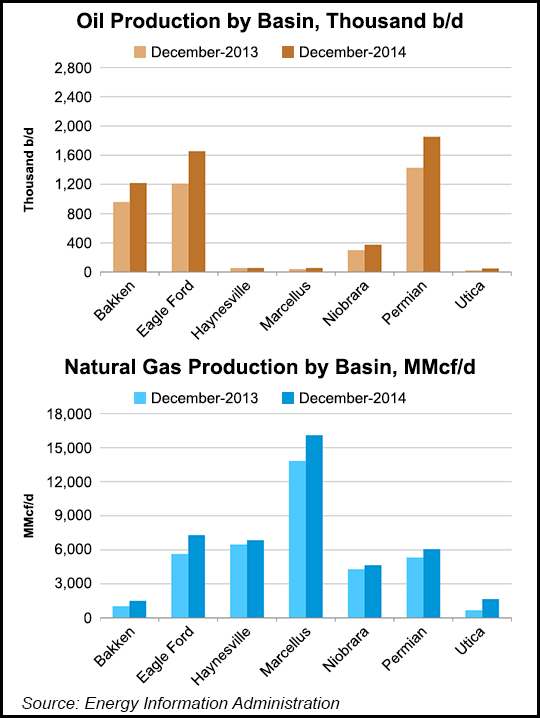

On the natural gas side of the equation, it will be the Marcellus Shale that continues to do the heavy lifting, EIA said in its latest Drilling Productivity Report (DPR). The Marcellus will produce an estimated 16.10 Bcf/d in December, compared to an estimated 15.89 Bcf/d in November and 15.82 Bcf/d in October (see Shale Daily, Oct. 15). The Eagle Ford Shale is expected to have a 116 MMcf/d increase in December to 7.30 Bcf/d.

In what has become recurring news, natural gas production increases compared to the previous month are expected in all of the plays included in the DPR: the Bakken Shale will be up 30 MMcf/d to 1.50 Bcf/d, the Haynesville Shale up 60 MMcf/d to 6.85 Bcf/d, the Niobrara formation up 67 MMcf/d to 4.65 Bcf/d, the Permian Basin up 82 MMcf/d to 6.01 Bcf/d, and the Utica Shale up 86 MMcf/d to 1.67 Bcf/d. The big seven plays will be up a combined 655 MMcf/d compared to November, EIA said.

Total oil production from the seven plays in December will increase 125,000 b/d (2.4%) compared to November, but significant increases continue to come from only the three biggest producers, EIA said. The Permian will increase 44,000 b/d to reach 1.85 million b/d in December, the Eagle Ford will increase 39,000 b/d to 1.65 million b/d, and the Bakken will add 28,000 b/d to reach 1.22 million b/d.

Three other plays — the Niobrara, Utica and Marcellus — will increase production by a combined 14,000 b/d, and the Haynesville’s oil production will stay flat at 57,000 b/d, according to the EIA report.

There were 1,417 drilling rigs operating in U.S. unconventional production basins on Nov. 7, according to Baker Hughes data, down six from the previous week but a 105-rig (8%) increase compared with a year ago. Five of the big seven plays have more rigs now than a year ago, but two of the most active — the Eagle Ford (212, down 14 from a year ago) and the Marcellus (82, down three from a year ago) have fewer rigs than they did in November 2013.

But new wells are becoming more productive, according to the EIA report. New-well gas and oil production is expected to be higher in December than in November across the big seven (except for oil production in the Haynesville, which will remain at 24 b/d), the agency said. On a rig-weighted average, new-well gas production per rig in the plays will be a combined 1.65 MMcf/d, a 1.1% increased compared with November, and new-well oil production per rig will be 322 b/d, a 2.2% increase from the previous month.

Some analysts believe onshore operators could soon begin laying down rigs in some U.S. oilfields, including fringe targets in the Eagle Ford and Bakken shales, if oil prices continue to squeeze the market (see Daily GPI, Oct. 28).

Collectively, the seven regions analyzed by the EIA for its DPR account for 95% of domestic oil production growth and all domestic natural gas production growth between 2011 and 2013.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |