Northeast Halloween Chill Scares Regional NatGas Basis Higher

Natural gas forwards markets were mixed at the start of the week as market players wrote off November positions amid little in the way of weather and shifted their attention to December.

Most market hubs across North America saw November roll off the board between 5 and 10 cents lower between Monday and Wednesday, according to NGI’s Forward Look.

Mild weather forecast for most of November and an improving storage picture helped suppress prices. The U.S. Energy Information Administration on Thursday reported an 87 Bcf build in storage inventories, above both the year-ago and five-year averages.

While most markets saw November roll off on a weak note, there were some exceptions. Northeast market hubs climbed a few cents in response to incoming cold weather that is expected to drop temperatures by more than 20 degrees in some areas this weekend, thereby lifting demand.

Indeed, power load and cooler weather were behind the run-up in prices, with maintenance adding fuel to the fire, a Northeast trader said.

Spectra Energy on Thursday conducted maintenance at the Cromwell compressor station, one of the pipeline’s major chokepoints, restricting flows to 770,000 Dth/d, down from a seasonal capacity of 859,000 Dth/d, according to a notice on Spectra’s website.

Meanwhile, cash prices jumped more than $1 at several Northeast points Wednesday, according to IntercontinentalExchange.

“Plus, you had some buying, just getting ahead of a very cold shot this weekend,” the trader said. “Next week will be interesting.”

While gains at the front of the forward curve were fairly muted, December prices in the Northeast posted double-digit gains as the market got spooked after Wednesday’s cash rally, according to another trader.

Algonquin Gas Transmission citygates led the pack as December jumped 45 cents between Monday and Wednesday to land at plus $10.477/MMBtu. Algonquin’s balance-of-winter (December-March) package rose by around 38 cents to plus $11.802/MMBtu.

The sharp spike at Algonquin reflects at least some concern in the market about supplies this winter. Encana this week said that work on its Deep Panuke offshore platform in Nova Scotia would continue into November. The company began work at the 300,000 Mcf/d facility in late September after rising water volumes in the gas stream several times over the past year created concern about the field’s sustainability during the winter months.

While one market player dismissed the maintenance event at Deep Panuke as “almost immaterial” due to the problems that have plagued the facility since its inception, another trader said the availability of the gas supplies would indeed impact prices.

“Basis would crash quite a bit if we had those volumes,” the trader said.

But Algonquin wasn’t the only market hub to post large increases this week. Texas Eastern Transmission Zone M3 and Transcontinental Gas Pipe Line Zone 6-New York each saw their December packages gain about 16 cents between Monday and Wednesday.

TETCO M3 December ended Wednesday at plus 63 cents/MMBtu, while Transco Zone 6-New York December finished at plus $2.663/MMBtu. Their balance-of-winter packages were strong as well, up 20 cents and 26 cents, respectively.

Although several projects are expected to come online in November that should help alleviate bottlenecks in the Northeast, the trader said some of the strength seen in the region has carried over from last winter.

“I think cash comes in much lower than where basis is, even if we have a strong winter,” he said. “It’s tough to forecast fear. We’ll just have to see if it turns to complacency.”

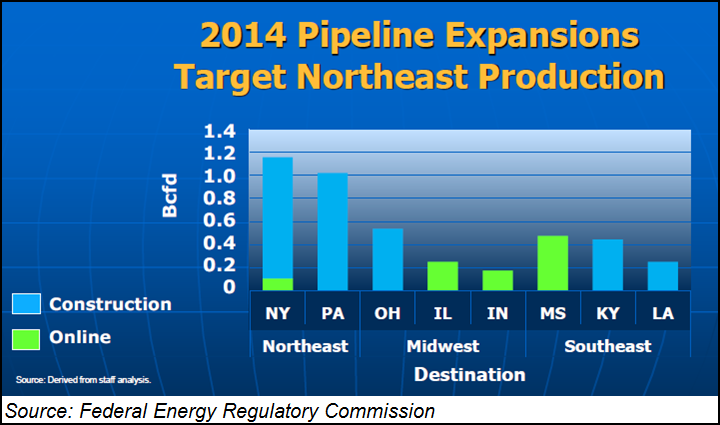

Nathan Harrison, NGI markets analyst, said the market could struggle to hold on to the gains as a significant portion of the new capacity coming online will serve the high-demand New York area.

“The FERC Winter Energy Market Assessment estimated that the total new capacity that will be coming online by the start of winter was about 4.3 Bcf/d, and about a quarter of this (1.1 Bcf/d) was going to serving New York,” Harrison said. “That’s a pretty good addition just to New York, so I’d say any bullishness due to winter weather there will at least be facing a little extra headwinds.”

Elsewhere across North America, December and balance-of-winter strips shifted mostly less than 5 cents as the quiet start to winter kept markets intact from Monday to Wednesday.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |