Markets | Infrastructure | NGI All News Access | Regulatory

B&V Survey Finds NatGas and Power Increasingly Linked

The thirst for natural gas among power generators is predicted to see “material” increases by 2020, according to a survey of energy industry participants recently conducted by Black & Veatch (B&V).

Compared with the firm’s 2013 survey, the 2014 “Strategic Directions: U.S. Natural Gas Industry” report reveals “heightened activity” instead of the prior year’s “cautious optimism,” B&V said.

Nearly 90% of industry respondents expect electric power generation to undergo material gas consumption increases by 2020, B&V said.

“What a difference a year makes,” said B&V’s John Chevrette, president of the firm’s management consulting business. “One year ago the mood across the natural gas value chain was one of cautious optimism. The 2014…report today reflects a marketplace surging with activity, driven in large part by low-cost shale gas. The strong demand for U.S. natural gas resources can help foster a new era of energy independence. Yet, it also requires industry and regulators to work together to ensure a sustainable path forward.”

It’s not just demand for gas among power generators that is expected to increase. Exports of liquefied natural gas (LNG) and the alternative fuel transportation sector will play a part, too, B&V said.

“Local distribution companies are seeking ways to secure low-cost gas from sources located closer to their markets,” the survey found. “Abundant supplies are encouraging capital flows to develop much needed pipeline infrastructure.”

Prices for natural gas and for power are growing increasingly linked; “74% of respondents cited the growth in natural gas for power generation as a key driver of future North American natural gas price rises,” B&V said.

Increased shale gas production, increases in the U.S. natural gas price, and benefits to the U.S. economy over the long term were cited as the top three potential outcomes of U.S. LNG exports, according to the survey.

This was the third year for the annual survey. It was conducted from July 23 through Aug. 25.

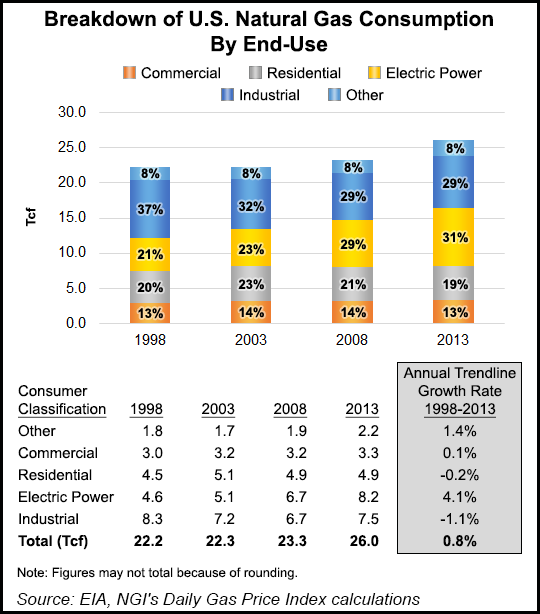

Patrick Rau, NGI director of strategy and research, said it is “not all that shocking that pundits expect electric generation to spearhead natural gas demand in the coming years, because that is exactly what has driven gas consumption since the power generation industry deregulated in the 1990s. Between 1998-2013, natural gas for power generation grew from 21% to 31% of total U.S. consumption, and grew at an annualized trend-line rate of 4.1% per year. Meanwhile, commercial and residential consumption growth was basically flat over that time period, while industrial consumption actually declined 1.1% per year during that span.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |