Marcellus | E&P | NGI All News Access

Fayetteville Still Powering Southwestern, But Marcellus Coming on Strong

The Fayetteville Shale delivered its highest quarterly production results ever for Southwestern Energy Co. in the third quarter, but double-digit growth from the expanding Marcellus Shale portfolio clearly grabbed the spotlight.

The Houston independent’s output rose 14% year/year to 196 Bcfe, nearly all natural gas-weighted, versus year-ago output of 172 Bcfe. Most of the output was from the Fayetteville, which totaled 126 Bcf, slightly up from year-ago production of 123 Bcf. Marcellus gas production, however, rose 47% to 66 Bcf, and even though it was only half that of Fayetteville’s it clearly is on a glide path to escalate.

Earlier this month, Southwestern agreed to pay $5.38 billion to Chesapeake Energy Corp. for 413,000 net acres and 1,500 wells in in southern Pennsylvania and northern West Virginia (see Shale Daily, Oct. 16). Average production in September from the assets being acquired was 336 MMcfe/d.

Southwestern CEO Steve Mueller, who helmed a conference call Friday, said a lot of the talk since the deal was announced has centered around a supposed “call on natural gas.” Mueller is long natural gas. All signs look positive for gas prices going forward, but there’s more than just his optimism for prices to the Chesapeake transaction, he told analysts.

“It wasn’t a call on natural gas,” Mueller said. “It was a call on quality. Quality wins in every price environment…”

Southwestern’s exposure in the Marcellus may not be as noticeable as some of the other independents, but it’s been steady. Between July and September, 18 wells ramped up, with gross operated output of 840 MMcf/d. For now, the company has been shutting in gas wells on the weekend to get more bang for the buck, COO Bill Way told analysts.

Production from about 14 gas wells is kept on “during high demand days of the week, but we are pulling back on wells on the weekends,” Way said. “The flexibility of our firm transport allows us to maximize the value of every Mcf we produce.”

However, once there is more gathering and more transportation options, Southwestern expects to be carrying a lot more gas out of the Northeast.

By the end of this year, the producer should have firm transportation “out of Pennsylvania under contract that totals more than 1 Bcf/d and increases to almost 1.2 Bcf/d of gas in 2016,” Way told analysts.

“Our current drilling budget allows us to ramp our production to match this increase to firm transportation capacity,” he said. “Additionally, on the midstream capacity…in northeast Susquehanna County [PA] now has 600 MMcf/d of compression capacity. This will be significant benefit to us as the productivity of the field continues to improve.”

Southwestern also is derisking the most northern part of its Susquehanna County acreage block, which it calls North Range, through 3-D seismic. A gathering system in the region is being extended as initial well tests are “encouraging,” Way said.

The company had 234 operated wells on production in Pennsylvania at the end of September and 102 wells in progress. All but one of the operated wells were horizontals, and of the 102 wells in progress, 36 were either waiting on completion or waiting to tie into pipe.

Three test wells in the Upper Marcellus also are set to be completed by the end of the year, with another test well to be done by early 2015. More tests are continuing on acreage acquired in 2013. Two wells drilled in Susquehanna County, PA near the New York border were “positive;” work has begun on a gathering system for future development.

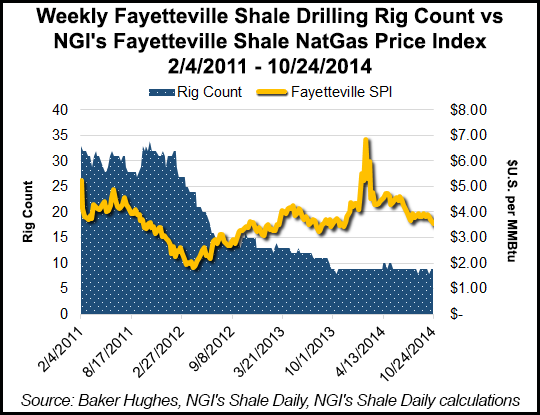

Meanwhile, the Fayetteville saw 106 wells placed on production in the quarter. Gross operated gas production totaled 2,058 MMcf/d at the end of September.

As Mueller often has said, Southwestern has been able to make money on gas because of its efficient wells.

For instance, in 3Q2014, horizontals drilled in the Arkansas formation had a completed cost of $2.4 million/well, with an average horizontal lateral length of 5,202 feet and time to drill to total depth of 6.5 days from start to finish. By comparison, just three months earlier, an average horizontal well with the same statistics cost about $2.5 million, the company said.

Southwestern ramped up 36 wells in the Fayetteville in 3Q2014 with initial production (IP) rates of more than 5,000 Mcf/d; 13 exceeded 6,000 Mcf/d. In the emerging Upper Fayetteville formation, 15 wells ramped up with average IP rates of 3.4 MMcf/d; three were above 5 MMcf/d and one exceeded 6 MMcf/d. Five more Upper Fayetteville wells are to be drilled by the end of the year.

Southwestern also is testing some of its 380,000 net acres in the Niobrara formation of northwestern Colorado. Three vertical wells have been drilled to date, and the first horizontal is under way.

Although its drilling efficiencies helped the price environment was not in Southwestern’s favor during the latest period.

Excluding derivative contracts, net income fell year/year to $178 million (50 cents/share) from $180 million (51 cents). Operating income from the exploration and production (E&P) segment was $189 million in 3Q2014, versus $223 million in 3Q2013. Net cash totaled $504 million, compared with $528 million in 3Q2013.

Costs rose in part on Marcellus midstream expenses. For the E&P segment, lease operating expenses per unit of production were 91 cents/Mcfe in 3Q2014, compared with 87 cents in the year-ago period. “The increase was primarily due to an increase in gathering costs in the Marcellus Shale and an increase in compression costs.”

Southwestern’s average realized gas price in 3Q2014 was $3.43/Mcf from $3.61 in 3Q2013. Hedging increased the average price by 22 cents in 3Q2014 from a gain of 55 cents in the year-ago period. At the end of September, Southwestern had about 117 Bcf of its remaining 2014 forecasted gas production hedged at an average price of $4.35/Mcf and 240 Bcf of 2015 forecasted gas production hedged at an average price of $4.40.

Without the impact of hedges in 3Q2014, the average price received for gas production was about 85 cents/Mcf lower than average New York Mercantile Exchange (Nymex) settlement prices; Southwestern’s prices were around 52 cents/Mcf lower in 3Q2013. As of the end of 3Q2014, “the company had protected approximately 101 Bcf of its remaining 2014 forecasted gas production from the potential of widening basis differentials through hedging activities and sales arrangements at an average positive basis differential to Nymex gas prices of approximately 1 cent/Mcf, excluding transportation and fuel charges.”

For the midstream services unit, operating income increased 13% year/year to $97 million, primarily on gains in gas volumes gathered and marketing margins. At the end of September, the segment was gathering 2.3 Bcf/d through 1,999 miles of gathering lines in the Fayetteville and about 0.4 Bcf/d from 63 miles of owned gathering lines in the Marcellus.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |