Marcellus | E&P | NGI All News Access

EQT to Profit From Fewer Wells, Longer Laterals

EQT Corp. plans to do more with fewer wells heading into the end of the year and into 2015, outlining a strategy on Thursday during its third quarter conference call that relies on longer laterals rather than more wells to increase output going forward.

The company said laterals on its Marcellus wells this year have been 1,000 feet longer than in the past at about 5,800 feet and its Upper Devonian laterals have been 3,000 feet longer at 6,800 feet. The strategy has been set for sometime now, company officials said, but progress came sooner than expected, leading EQT to lower its full-year guidance slightly from 465-480 Bcfe to 465-470 Bcfe, as a result of longer lead times between spudding wells and turning them into sales.

Although Wells Fargo analyst Gordon Douthat called details about the strategy “noisy,” given the current commodity price environment and the fact that it’s not yet translating into higher production, EQT CEO David Porges said the longer laterals will not only amount to better performing wells but will also reduce costs by 6% per lateral foot.

“The constraint on optimal growth was set by the pace of clearing enough land for longer lateral, multi-well pads, as we felt that was the most economic way to develop this asset (Marcellus/Upper Devonian),” Porges told analysts on the call. “This year has been pivotal in resolving this constraint as we now clear pads well ahead of our drilling pace even though our emphasis on multi-well pads and longer laterals stresses the best of land groups.

“This success, primarily as a result of fast tracking land acquisition of mineral rights adjacent to existing development areas, revisions of drilling permits pertaining to pads under development and other measures has come earlier than expected,” he added. “As a result, we decided to start increasing our standard lateral length earlier this year as part of ongoing efforts to further improve economic returns.”

Last year, the company averaged roughly 20.6 wells per pad, while this year it expects to average 11 wells under its new strategy. Steven Schlotterbeck, exploration and production president, said “all this will translate into slow increases in the Marcellus/Upper Devonian well count in 2015 compared to previous years.”

With a stated goal of growing production by 20% or more annually already in place heading into the third quarter, EQT still beat analyst expectations with 123.3 Bcfe of production last quarter, which was slightly above the high-end of its 118-122 Bcfe quarterly guidance. Those volumes were also 25% above 3Q2013 production of 96.9 Bcfe, while liquids production last quarter was up 87% to 2 million bbls versus the 1.2 million bbl it reported at the same time last year (see Shale Daily, Oct. 24, 2013). Liquids production got a hand from the Permian Basin of West Texas, which EQT entered in May after an asset swap with Range Resources Corp. (see Shale Daily, May 1) .

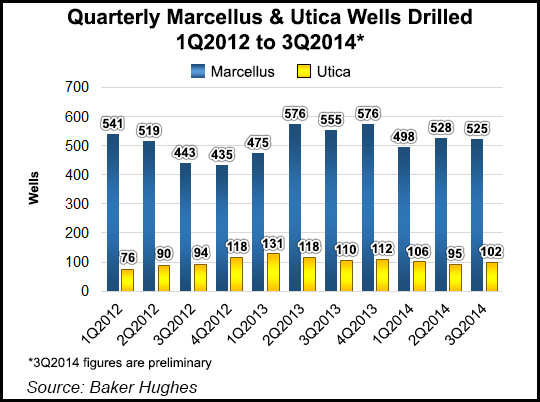

The Marcellus and Upper Devonian shales, however, still accounted for 79% of third quarter volumes. EQT spud 42 gross wells in the Marcellus last quarter, 13 Upper Devonian wells and 36 wells in Kentucky’s Huron Shale.

EQT also reported a boost in earnings, with net income up 12% to $98.6 million (65 cents/share) compared to $88.3 million (58 cents/share) in the year-ago period. But as expected from much of its peer group, lower natural gas prices put a dent in EQT profits, averaging $3.88/Mcfe last quarter versus the $4.20/Mcfe it earned last year at the same time (see Shale Daily, Oct. 9).

The company’s realized gas prices were below the average New York Mercantile Exchange price of $4.06/Mcf, EQT said, with negative Northeast basis of $1.38/Mcf up only slightly from last year’s average basis of $1.28/Mcf.

CFO Philip Conti said EQT was able to avoid a further drop in income by taking advantage of firm transportation (FT) to different markets outside the Northeast and selling unused FT to third parties.

Taxes related to one-time deals earlier in the year, such as EQT’s sale of its Jupiter natural gas gathering system in southwest Pennsylvania to affiliate EQT Midstream Partners LP (EQM) for $1.18 billion, also offset profits (see Shale Daily, May 1).

EQM, for which EQT is the general partner with a 32% limited interest, was also a major focus of the call. Year-over-year net income there dropped from $59.2 million to $56.5 million on lower transmission charges and gathering fees. But company officials said given EQM’s footprint and ever-increasing volumes in the basin, the partnership’s opportunities for growth appear unlimited.

They added that the system has grown exponentially in recent years, and given EQM’s earning results are consolidated with EQT’s, they continued to say that alternatives are being explored to better reflect its value in EQT’s stock. Porges also said EQM will begin to steadily fund its own projects instead of having EQT foot its bills for future dropdowns.

“Strategically, we think more and more of the midstream growth projects should be funded at EQM instead of being built at EQT and then dropped. That was always in EQM’s best interest, but they were too small to wear this investment in construction projects and frankly EQT was able to profit from selling projects to EQM once they were built and contracted,” he said. “With EQM’s growth and high coverage ratio, it can afford to warehouse larger projects.

“Does EQT stock price reflect this general partner value? It is impossible to be certain, but we think it is highly unlikely that it does,” Porges added. “This fact, along with the growing [general partner] value estimate reinforces our view that we must do something else to highlight that value.”

Porges stopped short of saying what options are being considered, but said a decision would likely be announced by the end of the year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |