Markets | NGI All News Access | NGI Data | NGI The Weekly Gas Market Report

Cash Takes Double-Digit Drubbing; Futures Clock 11-Month Low

Futures prices may have taken a hit from an uninspired weekly Energy Information Administration (EIA) storage report Thursday, while physical market trading for Friday delivery took no prisoners and left only a handful of points in the plus column.

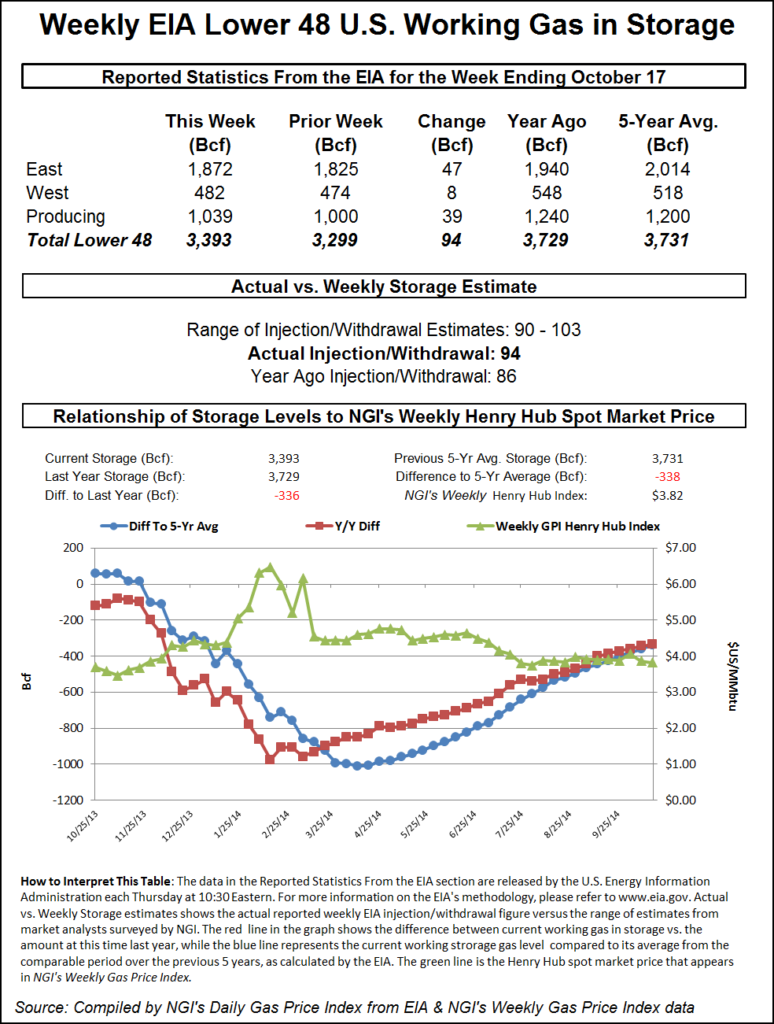

Selling was pervasive, with the East, Northeast and Marcellus points dropping sharply as weather conditions were forecast to moderate considerably. Losses of more than a dime were widespread in the Gulf Coast, Great Lakes and Midcontinent. The overall market fell 16 cents. The EIA reported an inventory build of 94 Bcf, somewhat less than what the market was expecting, and prices gasped higher only to finish lower on the day. At the close, November was down 3.7 cents to $3.622 and December had fallen 3.9 cents to $3.706. December crude oil jumped $1.57 to $82.09/bbl.

A surge of warm temperatures in the wake of a nor’easter departing the Northeast was all it took to send next-day gas prices careening lower. Friday temperatures in the Mid-Atlantic were not only seen as much as five degrees above normal, but also suggested a trend of well above normal temperatures for next week as well. “A great deal of sunshine and seasonal temperatures will return to the [Philadelphia] region on Friday and into the upcoming weekend,” said Brett Rathbun, AccuWeather.com meteorologist.

“As the nor’easter moves towards Nova Scotia and Newfoundland, sunshine will return for the weekend and early next week around Philadelphia. A disturbance will move through southern Quebec Saturday night into Sunday morning; however, rain should remain over New York state and New England. This is good news for anyone with outdoor or travel plans this weekend in the Philadelphia area.

“Behind this disturbance, winds will pick up for Sunday as winds could gust up to 35 mph at times. The winds will send fallen leaves racing along through streets and neighborhoods. [Wind chill] temperatures will be in the 50s at times on Sunday, [and] heading into the beginning of next week, a surge of warm air will move into the Northeast with temperatures 10-15 degrees above average. The weather will feel more like the middle of September for a few days.”

Wundergroud.com predicted that the high Thursday in New York of 54 would jump to 66 Friday and hold for Saturday. The normal high in the Big Apple this time of year is 61. By next week highs in the 60s and 70s are expected. Philadelphia’s Thursday maximum of 56 was seen reaching a balmy 66 on Friday and 67 by Saturday. The seasonal high in Philadelphia is 60. Boston’s Thursday max of 57 was predicted to drop to 54 Friday and surge to 64 on Saturday. The normal high in Boston is 59.

Forecast power loads and next-day power prices took it on the chin. ISO New England predicted that Thursday’s peak load of 16,510 MW would drop to 15,710 MW Friday and slide to 14,600 MW Saturday. The PJM Interconnection forecast peak power requirements Thursday of 32,801 MW dropping to 30,331 MW Friday and 27,966 MW Saturday.

On IntercontinentalExchange, next-day peak power at the ISO New England’s Massachusetts Hub dropped $3.72 to $32.78/MWh, and at the PJM West terminal Friday peak power shed $5.89 to $36.21/MWh.

At the Algonquin Citygates, Friday gas came in at $2.19, down a stout 55 cents, and gas on Iroquois Waddington fell 52 cents to $3.04. On Tennessee Zone 6 200 L, Friday packages changed hands at $2.35, down 40 cents.

In the Mid-Atlantic and Marcellus, declines of a half-dollar or more were seen. Gas on Tetco M-3 fell 76 cents to $1.84, and deliveries to Millennium were seen at $1.99, down 42 cents.

Gas on Transco Leidy gave up 54 cents to $1.90, and on Dominion South parcels were seen at $1.86, down 59 cents. Gas on Tennessee Zone 4 Marcellus shed 42 cents to $1.80.

In the Great Lakes, price declines were not as steep but just as pervasive. Gas on Alliance for Friday delivery shed 12 cents to $3.64, and packages at the Chicago Citygates retreated 14 cents as well to $3.64; 14-cent declines were also seen on Consumers and Michcon to $3.64 and $3.63, respectively. Gas at Demarcation dropped 7 cents to $3.63.

Traders attempting to forecast the week’s storage report were looking for an increase of about 100 Bcf. A Reuters survey of 23 traders and analysts revealed an average increase of 97 Bcf with a range of 90 Bcf to 103 Bcf. United ICAP was looking for a build of 98 Bcf, and Bentek Energy’s flow model anticipated an injection of 99 Bcf.

The actual EIA figure was an increase of 94 Bcf in its 10:30 a.m. EDT report. November futures had made it to a high of $3.681 by the time the number was released and by 10:45 a.m. November was trading at $3.665, up a miserly 0.6 cent from Wednesday’s settlement.

“It doesn’t look like there is a strong push to do anything. There was a pretty lackluster response,” said a New York floor trader.

Others suggest a tighter supply-demand balance. “The 94 Bcf build for last week was a match with the prior period, below the consensus expectation for 97-98 Bcf,” said Tim Evans of Citi Futures Perspective. This was also a clear step down from the 103 Bcf estimate our model had produced, and suggests some tightening of the recent supply-demand balance that would also translate into lower net injections for the weeks ahead.”

Inventories now stand at 3,393 Bcf and are 336 Bcf less than last year and 338 Bcf below the five-year average. In the East Region 47 Bcf were injected and the West Region saw inventories increase by 8 Bcf. Stocks in the Producing Region rose by 39 Bcf.

With mild weather remaining on the horizon for the foreseeable future, storage injections may continue well into November, not only prolonging the build in inventories but shortening the available time for withdrawals. A stout build in inventories is likely next week as forecasts call for below-normal accumulations of degree days for the week ending Oct. 25.

The National Weather Service (NWS) predicts below-normal accumulations of combined heating and cooling degree days in major population centers. NWS says New England will see 95 degree days (DD), or 25 fewer than normal, and the Mid-Atlantic will have to endure 92 DD, or 12 fewer than its seasonal tally. The greater Midwest from Ohio to Wisconsin should experience 99 DD, or 14 fewer than normal.

Industry consultant Genscape utilized a combined sample of storage facilities as well as supply/demand-based analyses to formulate its 98 Bcf injection estimate. The company said its models “expect the EIA [Energy Information Administration] will announce 98 Bcf of gas was injected during the week ending Oct. 16. The forecast is a composite of Genscape’s supply and demand model — which is forecasting an 84 Bcf injection — and our adjusted flow sample of storage facilities, which is predicting a 101 Bcf injection.

“A 98 Bcf would be the second largest injection for week 42 in the past five years (103 Bcf was injected for the week in 2011). Current working gas inventories stand at 3,299 Bcf. Our models have been in the 98 Bcf range for this storage week for several weeks now, resulting in only minor modifications to our end-of-season estimate of 3.55Tcf,” the firm said.

Bentek Energy predicted a 99 Bcf increase utilizing its flow model but offers the caveat that that number may be too high. It said there was a risk to the forecast in that NGPL reported a large 4 Bcf “transfer” of gas that Bentek is treating as a reclassification from base gas to working gas. If this reclassification assumption is not correct, Bentek says its estimate might be too high.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |