Bakken Shale | E&P | NGI All News Access

Bakken Rail Crude Shipments Likely Strong Into 2016, Fitch Says

With significant new pipeline capacity not likely before some time in 2016, burgeoning Bakken crude oil production in North Dakota will continue to rely on rail to access the three coasts: East, West and Gulf, according to a report by Fitch Ratings.

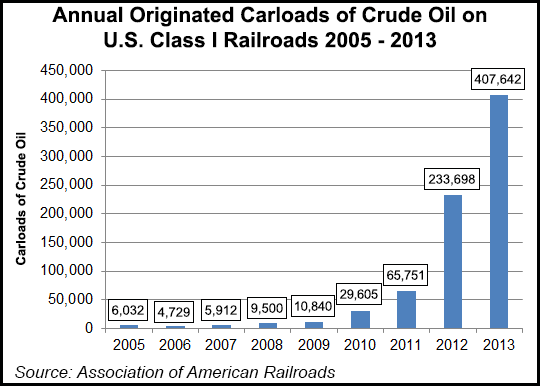

Noting that the large continued ramp-up of production is now steady at more than 1 million b/d, Fitch’s report said producers will continue to rely heavily on rail and truck shipments of oil as the pipeline bottlenecks continue. “Rail is estimated to provide 60% of regional takeaway capacity, and costs to ship by rail affect spread levels,” the report said.

“From a credit perspective, Bakken exposure is viewed as favorable, especially as it forms a portion of a diversified upstream portfolio,” said “Bakken Shale Report,” which is billed as an analysis of themes in the Bakken Shale. “Volumes in the [Williston] Basin should continue to grow, as Bakken producers are enjoying strong margins on production in the current oil price environment.”

Bakken supplies now account for about 13% of the U.S. domestic oil production, yet regional gathering and takeaway infrastructure is still “relatively undeveloped,” the report said. “While pipeline investment has been slowed by a lack of firm commitments from producers, announcements this summer to develop new pipelines to source Bakken supplies signal an increased emphasis on pipelines.”

Fitch is buoyed by proposals from Energy Transfer Partners LP (ETP), Enterprise Products Partners LP, and Enbridge Energy Partners LP “signal an increased emphasis on pipeline development.,” Fitch noted. The report also said the additional pipeline capacity won’t be a factor until into 2016.

In the meantime, the cost of rail shipments of oil to East or West Coasts costs $10-15/bbl, compared to pipeline costs of $2-5/bbl in the Midwest and rail costs of $10-12/bbl to the Gulf Coast. “Until significant new pipeline capacity comes into play in 2016, producers will continue to utilize significant rail capacity to place their crude in the most economic markets,” Fitch said.

At the same time, Fitch expects that credit rating impacts on master limited partnerships (MLP) will be neutral, given “increasing value for pipeline capacity from growing Bakken production and anticipated firm contracts for pipeline shippers.”

Bakken crude continues to be priced at what Fitch said is a significant discounts to both WTI and Brent prices.

“While pipeline capacity has struggled to keep up with volumes, Fitch expects supply/demand will begin to come more into balance in 2015-16 as market participants strive to find the most economic placement for their barrels.”

Bakken crude has grown as a compound annual growth rate of 34% since 2007, and assuming annual growth rates in the 10-30% range going forward, Fitch thinks total takeaway capacity, including rail, should exceed what it called even the most optimistic growth forecasts.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |