Marcellus | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Utica Shale

Antero Slashes Appalachian Spend on Lower Oil, NGL Prices

Appalachian pure-play Antero Resources Corp. plans to cut its capital spending and development activity this year in response to sliding oil and natural gas liquids (NGL) prices.

Although Antero is the first Appalachian operator to publicly announce its strategy for this year, it is not the only one planning to scale back, as its peers operating in other basins have responded similarly to falling oil prices as the budget season gets underway.

Antero said late Tuesday it would cut its 2019 drilling and completion budget to a range of $1.1-1.25 billion from last year’s level of $1.3 billion. Total spending, including land capital, is forecast to decline to a high of $1.35 billion from $1.45 billion in 2018.

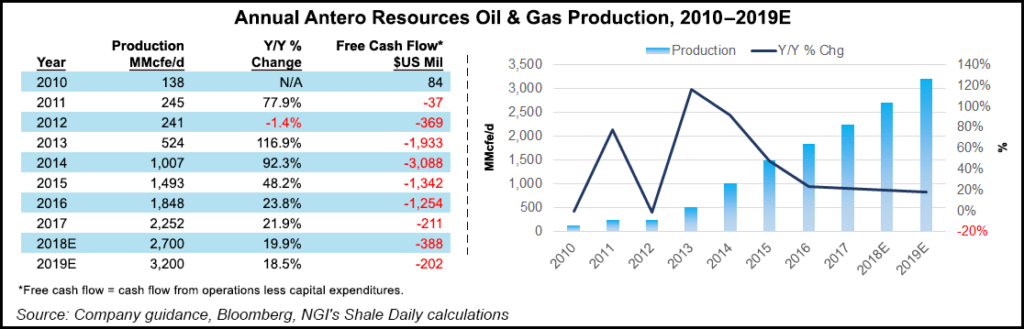

While year/year production is expected to increase by up to 20%, 2019 guidance came in slightly below financial analysts’ expectations at 3.150-3.250 Bcfe/d. Antero, one of the nation’s largest NGL producers, was emboldened by higher prices last year to focus more intently on liquids-rich locations in the Marcellus Shale of West Virginia, with no plans for activity on drier acreage in Ohio.

NGLs and oil are still expected to average 154,000-164,000 b/d in 2019, a 26% increase at the high-end over last year’s levels. The company plans to run five drilling rigs and four completion crews this year, down from one to two crews from 2018.

“We remain focused on capital discipline and have the operational and financial flexibility to adjust our development plan with changing commodity prices,” said CEO Paul Rady. “…To the extent that commodity prices strengthen, we expect capital allocation to reflect an appropriate mix of growth and return of capital to shareholders while continuing to maintain a strong balance sheet.”

Overall, Antero’s plan for the year includes 115-125 well completions, with an average lateral length of 10,200 feet, as well as 120-130 wells drilled with an average lateral length of 11,900 feet.

The company also curbed an aggressive longer-term production growth target to better align its capital expenditures with cash flow. Antero is now targeting a 10-15% compound annual growth rate from 2020 through 2023. It had guided early last year for a growth rate of 24% through 2020 and 20-24% in both 2021 and 2022.

Antero also announced that it is transporting up to 50,000 b/d of propane and ethane on the Mariner East (ME) 2 pipeline, which started partial service late last month. The company was already moving ethane on ME 1, but the the new service on ME 2 is expected to improve propane and butane netbacks by up to $4.00/bbl.

The company’s cash unit costs guidance has also increased as costs are now spread over lower volumes, while expenses related to its unused firm transportation also increased for this year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |