NGI The Weekly Gas Market Report | Coronavirus | LNG | LNG Insight | Markets | NGI All News Access

Another Specter Rises Over LNG as European Demand Seen Threatened by Coronavirus

Drastic measures being taken by governments in Europe to stop the spread of the coronavirus are likely to impact natural gas consumption on the continent, which has been a major destination for liquefied natural gas (LNG) supplies, particularly those exported from the United States.

Some of the countries that have been hit hardest by the virus, including Italy, France and Germany, are among Europe’s largest natural gas consumers. The advance of the virus has been most aggressive in Italy, which consumed about 3 Tcf of natural gas last year, according to BP plc’s latest Statistical Review of World Energy. Italy has shut down most activity and restricted travel.

“I’m expecting that we could see similar responses across the continent, where there’s further closures of industry and lockdowns,” said Rystad Energy’s Carlos Torres-Diaz, head of gas and power markets. He spoke with NGI on Friday from his home in Norway, where he was working one day after the country shuttered schools and some businesses. According to his calculations, year/year industrial and power gas demand in Italy has declined by 5-10% so far this month.

French multinational energy management firm Schneider Electric said the same Thursday, noting that Italian power demand has been steadily declining as lockdowns reduce all types of economic activity. Power consumption dropped from 4% below long-term averages earlier this month to 8% on Wednesday, according to Schneider.

Torres-Diaz estimated that industrial and power gas demand could fall by roughly 5% below year-ago levels across Europe for a maximum of one month as governments work to buy time in responding to the virus, which he added wouldn’t weigh heavily on natural gas flows.

While there is a drop in seasonal residential demand across the continent around March as warmer weather sets in, industrial demand remains largely flat throughout the year, Torres-Diaz said.

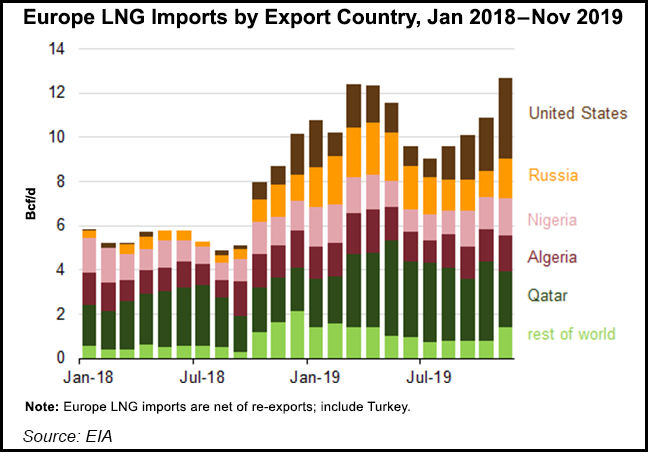

Europe has a lot of demand and a large wholesale market. It also has the kind of ample regasification and storage capacity that allows the world’s excess natural gas to find a home. The continent’s LNG imports hit record levels of more than 12 Bcf/d last year as global supplies increased and prices dropped, according to the Energy Information Administration.

However, Europe’s ability to continue taking in natural gas had already been strained by weak winter weather, regular pipeline imports, high storage levels and an abundance of low-priced spot cargoes that were finding their way to the continent’s shores. The situation has remained largely the same since the withdrawal season got underway and with summer injections fast approaching, the potential impact of the coronavirus on demand only complicates the outlook.

“Overall, we were not expecting Europe to be able to increase further their LNG imports this summer, or this year,” Torres-Diaz said. “And obviously with the virus, it’s another bearish signal for demand.”

But Torres-Diaz and other analysts stressed that there have so far been minimal impacts to demand in Europe. No ships have been diverted as they were in China earlier in the year when the virus escalated. But the situation has the market on edge.

“I wouldn’t be surprised if in a few days or weeks we start seeing some impacts because demand could decrease given that countries are being put in lockdown,” said Kpler’s Nathalie Leconte, a Paris-based LNG analyst.

She told NGI that while Europe was an even more important destination when the coronavirus broke out in China and nearby countries, Asia could play a similar role now that the virus is spreading in Europe.

Diverted European cargoes “would most likely all go to Asia,” she said. India, Bangladesh and Pakistan have been opportunistic buyers as of late, taking advantage of historically low prices in the spot market. For example, India’s imports hit a record high of 2.75 million tons in February, according to Kpler.

“India has been absorbing the extra cargoes that couldn’t be delivered in Asia. They have as well issued a lot of tenders in the past few weeks” to purchase cargoes now that prices have dropped exponentially, Leconte said.

If enough demand is destroyed on the continent, don’t expect the sorts of force majeures in Europe that Chinese buyers tried declaring to refuse volumes they were obligated to buy under long-term contracts as they attempted to defer cargoes due to the virus, Torres-Diaz said.

While long-term contractual deliveries will continue to enter Europe via pipeline and import terminals, a lot of the LNG volumes arriving in Europe have been spot purchases that might not be necessary if demand declines.

“Exporters might have to look for alternatives in order to commercialize their gas,” Torres-Diaz said. “There’s enough regasification capacity across Asia to be absorbing this. A lot of Asian buyers are very price sensitive, so they will only import if the price is competitive, especially versus coal.” Right now, natural gas is highly competitive in Asia, especially given the recent fall in oil prices that gave a lift to oil-indexed LNG buyers.

Europe is a major destination for U.S. LNG exports. According to NGI and U.S. Department of Energy calculations, 215 of the 538 cargoes exported from the country last year made their way to Europe. Leconte noted that most U.S. cargoes headed to Europe will be insulated by long-term contracts from any demand destruction. U.S. contracts also don’t include clauses restricting destinations, so spot cargoes can easily find a home elsewhere if netbacks continue to be positive.

ClipperData’s Kaleem Asghar, director of LNG analytics, said he doesn’t believe supply or demand will be impacted in any significant way in the near term in Europe or elsewhere. He noted that even after the disruptions caused in North Asia last month as the virus escalated and China took steps to curb its spread at the epicenter, demand has since stabilized there.

As of Thursday, 18 cargoes had arrived in China over the previous seven days versus the 11 that were unloaded during the same period last year, according to ClipperData. Across the world, the number of vessels floating with LNG aboard, an indicator of gas flows, has declined from a peak of 20 in mid-February to just nine on Friday. Four of those were near Europe, Asghar said, and they were floating only because of high winds that have buffeted the continent in recent weeks and made it difficult to unload.

Moreover, given oil’s rout in recent days, Brent-linked LNG prices slid to $5.71/MMBtu on Thursday, compared to about $12.00 at the same time last year, according to NGI calculations, which assume a 17.2% slope. Meanwhile, key European natural gas benchmarks that factor heavily into LNG prices have plummeted on the global oversupply. Torres-Diaz noted that even if some European demand is destroyed by measures to slow the coronavirus, it’s unlikely to bring down prices much more, which he said have likely hit bottom at recent levels of about $3.00 or less.

The larger consequence of the coronavirus and the oil price war that has weighed on LNG could come for liquefaction projects across the globe, including those in the U.S., that are working toward final investment decisions at a time when it was already difficult to secure long-term contracts given how low prices have been.

“Whatever I’m buying right now, I’ll end up paying lower prices,” Asghar said of the spot market, brent-linked prompt month contracts and even longer-term oil-indexed purchases. “It has been a buyers market.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |