Regulatory | NGI All News Access

AMLO Following Through On State-First Energy Rhetoric in Pipeline Conflict

Since assuming the presidency of Mexico last December, Andrés Manuel López Obrador has been fulfilling his campaign pledge to ensure the dominant roles of national oil company Petróleos Mexicanos (Pemex) and state power utility Comisión Federal de Electricidad (CFE) in the local energy industry.

CFE’s contractual dispute with four natural gas pipeline developers is the latest evidence of the president’s unwillingness to compromise on this vision.

“He has been extremely consistent about what he thinks the energy sector should look like and the role of Pemex, of CFE, and the government in it,” Eurasia Group’s Carlos Petersen, senior analyst for Latin America, told NGI’s Mexico GPI.

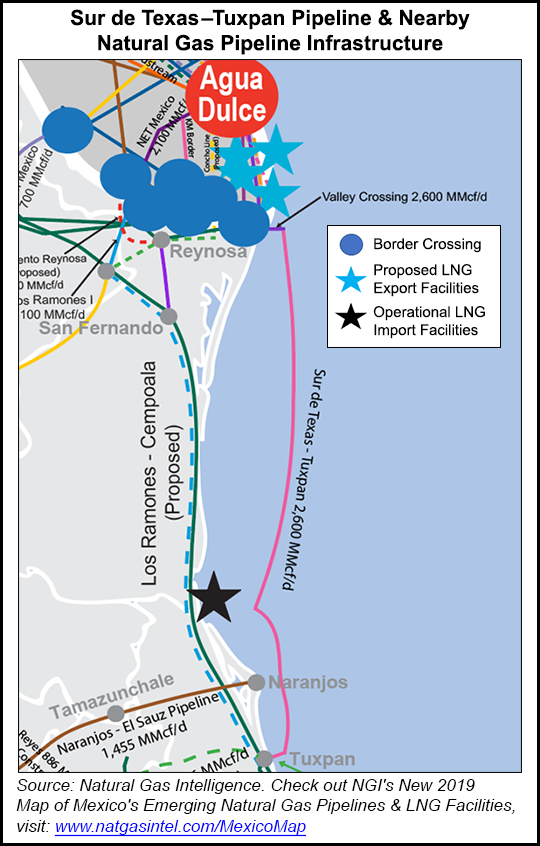

CFE is seeking international arbitration to amend the force majeure clauses of the 25-year firm capacity agreements that it signed for seven pipeline projects that have faced delays, including the 2.6 Bcf/d Sur de Texas-Tuxpan undersea pipeline.

Developers TC Energy Corp. and Infraestructura Energética Nova (IEnova) announced the completion in June of the pipe’s construction. Anchor customer CFE, however, has refused to allow it to start commercial operation, pending the contract’s renegotiation.

IEnova is a subsidiary of San Diego, Calif.-based Sempra Energy.

“With regard to Mexico in general, we are not pleased with recent developments regarding two of IEnova’s pipelines,” Sempra President Joseph Householder said Friday during the firm’s second-quarter earnings call.

In addition to the marine pipeline, CFE is also seeking to amend the contract for the Guaymas-El Oro section of IEnova’s Sonora pipeline. Guaymas-El Oro has been inactive since 2017 amid a dispute with a faction of the Yaqui indigenous tribe.

Conversations between Sempra and CFE “have been focused specifically on the force majeure provisions,” said CEO Jeffrey Martin.

Householder added that Sempra is confident of its ability to amicably resolve the dispute with CFE in a timely manner.

Under the force majeure clauses of the seven pipelines, CFE has had to make capacity payments to the developers, despite the pipelines not being in operation. López Obrador and CFE general director Manuel Bartlett have called the contracts “abusive.”

Petersen said the administration views the capacity payments as anathema to López Obrador’s public sector austerity program. “So my view is that the government will continue fighting.”

Mexico’s senate and chamber of deputies, which López Obrador’s Morena coalition controls, approved a 2019 budget that saw dramatic cuts for autonomous energy regulators Comisión Nacional de Hidrocarburos (CNH) and Comisión Reguladora de EnergÃa (CRE), as well as for the Agencia de Seguridad, EnergÃa y Medio Ambiente (ASEA), which is the environmental regulator for the oil and gas industry.

Pemex and CFE, meanwhile, both received budget increases.

Meanwhile, despite repeated overtures from industry groups and public sector technocrats, López Obrador remains highly critical of Mexico’s 2013-2014 constitutional energy reform, which opened the hydrocarbon and power sectors to competition from non-state firms.

Pemex’s 2019-2023 business plan, released in July, extinguished any lingering hope that the 100% state-owned firm would seek joint-venture partnerships with other operators in the upstream segment.

“We were always very skeptical about that optimism or that perception that the pragmatic López Obrador would come out and at some point would understand how much they need the private sector to develop Pemex,” Petersen said.

Before the plan’s publication, López Obrador had already suspended bid rounds, farmout tenders for stakes in Pemex acreage, and the migration of oilfield services (OFS) contracts to exploration and extraction contracts.

Pemex instead is accelerating the development of 20 onshore and shallow water fields entirely via CSIEEs, a type of oilfield services (OFS) contract that the company used prior to the energy reform. Pemex aims to achieve crude output of 2.53 million b/d by 2023, up from 1.67 million currently.

“There are different estimates … about how much investment Pemex, or in general, the energy sector in Mexico would require to at least maintain production at current levels, [let alone] bring it up to what the government is expecting,” Petersen said. “And so far, what the government has proposed is not close to that.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |