NGI The Weekly Gas Market Report | Infrastructure | NGI All News Access

Amid Scarce Gas Supply, Southeastern Mexico Said Vulnerable to Power Outages

Having already suffered prolonged power outages in March and April, Mexico’s Yucatan Peninsula faces the risk of more blackouts as summer approaches because of scarce natural gas supply and insufficient power transmission infrastructure, according to experts.

The fast-growing region depends on two main sources for its electricity, Talanza Energy Consulting’s David Rosales, midstream and downstream partner, told NGI’s Mexico GPI.

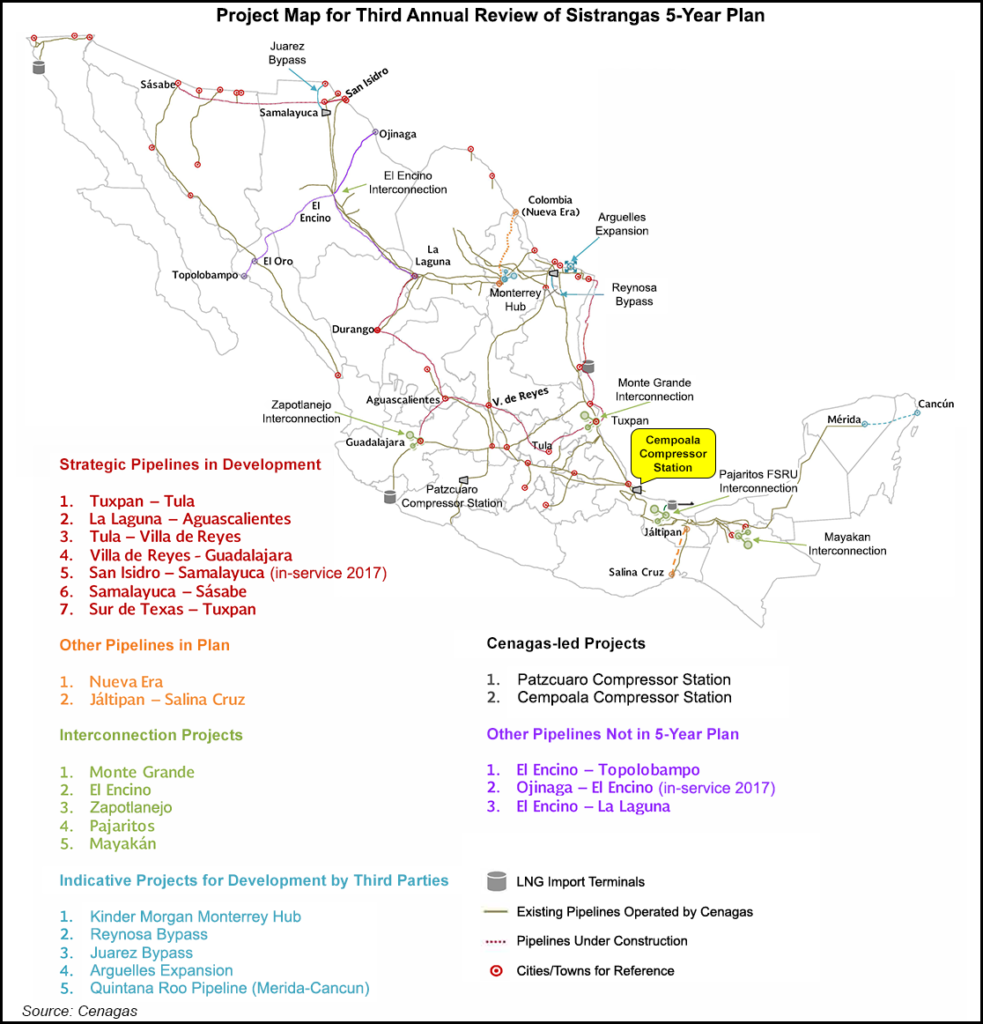

One is local gas-fired power plants, which rely exclusively on natural gas produced by state oil company Petróleos Mexicanos (Pemex) to operate, since the peninsula is not yet connected to the Sistrangas national pipeline grid. The second is because of transmission lines that supply power from other regions of Mexico via the Tehuantepec isthmus.

This scenario presents a three-fold problem, according to Rosales and other local energy experts who have been sounding the alarm in recent days.

The first issue is that the aging transmission lines connecting the peninsula with the rest of the country are already operating near capacity. In addition, Pemex’s natural gas production has been in decline since 2009, and the company has yet to present a convincing plan for how to reverse that trend. Third, and perhaps most crucially, natural gas infrastructure projects designed to alleviate the supply issues have faced repeated delays.

The risk of continued power outages is “very high,” said Rosales. He thinks the gas and power supply challenges will plague Yucatan not only this summer, but next summer as well.

Independent energy analyst Rosanety Barrios told NGI that, “there is not sufficient generation capacity because there is no natural gas in the peninsula. If there is excess demand on the transmission line, the system overloads.”

Essentially all of the peninsula’s locally produced electricity comes from five thermal power plants with a combined effective capacity of 1,754 MW, according to the government’s Prodesen 2018-2032 power sector development plan.

Three of these plants, with a combined capacity of 1,261 MW, rely exclusively on natural gas, while the other two, with a combined capacity of 493 MW, can also burn costlier fuel oil.

Nera Economic Consulting’s Veronica Irastorza, associate director, tweeted last week that the supply of gas to the peninsula “depends totally” on Pemex, and that supply alternatives are urgently needed.

Reports in the local press recently quoted the chairman of Mexico’s Comisión Nacional de EnergÃa (CRE), Guillermo GarcÃa Alcocer, warning of the risk posed by transmission and gas supply constraints in the region as well.

Pemex-produced gas arrives to the Peninsula via the 780-kilometer (485-mile) EnergÃa Mayakan pipeline, which is majority-owned by French multinational utility Engie. Mayakan has the capacity to transport 250 MMcf/d, but it is currently flowing well below that amount because of Pemex’s declining wet gas production in southeastern Mexico, Rosales said.

Data from EnergÃa Mayakan’s electronic bulletin board shows that gas flows on the pipe averaged under 50 MMcf/d in February.

Rosales also highlighted that the existing transmission infrastructure was designed under the assumption that Yucatan power plants would be able to receive at least 200 MMcf/d of gas.

The reconfiguration of the Cempoala compressor station in Veracruz state, as well as Engie’s planned expansion and interconnection to the Sistrangas of the Mayakan pipe, are both meant to alleviate the Yucatan’s gas supply problems.

However, to fulfill this objective, the Cempoala and Mayakan projects both depend on the interconnection to the Sistrangas of the long-awaited 2.6 Bcf/d Sur de Texas-Tuxpan offshore pipeline, a milestone which has been delayed multiple times, with the latest projections suggesting start-up in June.

The Texas-Tuxpan pipe, which will supply U.S.-produced gas to Mexico, is a joint venture between TransCanada Corp. and Infraestructura Energética Nova (IEnova), the local subsidiary of U.S.-based Sempra Energy.

Engie has not provided the expected completion date of Mayakan’s interconnection and expansion.

Rosales said the outlook for domestic gas production in Mexico over the coming months is “very bad.” Injection of natural gas by Pemex into its southeastern region processing centers has fallen from above 1.8 Bcf/d in 2015 to under 1 Bcf/d currently, according to data from energy ministry Sener.

Despite Pemex’s stated intention to accelerate development of the gas-rich Ixachi field in Veracruz, Rosales said the project will only partially offset the decline in gas production at Pemex’s mature onshore and shallow water projects in southeastern Mexico.

Rosales also called the recent cancellation of the Pajaritos floating storage and regasification unit (FSRU), a project designed to shore up gas supply in the region, a “terrible decision.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |