E&P | Eagle Ford Shale | NGI All News Access | Permian Basin

Abraxas Looking to Sell Permian Acreage, Reduce Borrowing Base

San Antonio, TX-based Abraxas Petroleum Corp. said it plans to sell acreage in West Texas to help pay down its debt and that it expects to cut its borrowing base by one-fifth at the end of the month.

During a conference call to discuss fourth quarter earnings on Wednesday, CEO Bob Watson said the exploration and production (E&P) company is planning to sell 5,227 net acres in Texas’s Ward and Reeves counties. The acreage lies in the Permian Basin’s Delaware sub-basin and is prospective to the Bone Spring formation and Wolfcamp Shale.

“We are currently marketing to a targeted group, the shallow rights from the base of the Wolfcamp to the surface, while keeping the deep gas production, which has considerable measured upside,” Watson said. “We’ve had some offers to date. They don’t meet our expectations and we’re not going to give these assets away, so we’ll keep the marketing process going.”

Abraxas is also looking to unload a ranch in Pecos County, TX, totaling 12,100 net surface acres. Watson said the company acquired the ranch several years ago and drilled there, but current natural gas prices do not warrant further activity.

Proceeds from the sale of either package would go toward paying down the company’s revolver, Watson said. The company has been “in constant communication” with its bank group and is expecting a 20% reduction to its borrowing base on April 1. According to a 10-K filing with the U.S. Securities and Exchange Commission on Tuesday, the company currently has $134 million outstanding on its borrowing base of $165 million.

“Although we’re justifiably criticized for our liquidity and reliance on bank debt, I would like to point out [that] we are unquestionably solving [this issue] today with substantial equity value, unlike many of our peers, whose obligations outweigh the current value of their assets,” Watson said.

The CEO added that the company is still trying to form a joint venture (JV) to test and develop its acreage prospective to the Austin Chalk and the Eagle Ford Shale in Hidalgo County, TX. The JV effort “is progressing a little slower than I had hoped, but I expect to have an executed letter of intent any day,” Watson said.

According to the 10-K, Abraxas held 86,525 total net acres at the end of 2015 — a figure that includes developed (44,729 net acres), undeveloped (35,328) and fee mineral (6,468) acreage. Broken down by play, the company held 44,014 net acres in its Rocky Mountain region, which includes the Williston Basin; 28,370 net acres in the Permian Basin; and 14,141 net acres in the onshore Gulf Coast region.

The 10-K indicated that about 5,727 net acres of undeveloped acreage are to expire before the end of 2018. Of that total, 822 net undeveloped acres in the Permian are set to expire at the end of 2016, followed by another 79 at the end of 2017. Another 280 net undeveloped acres in the Rockies will expire at the end of 2016, followed by 647 in 2018. Abraxas is scheduled to shed 672 net undeveloped acres in the onshore Gulf Coast region at the end of 2016, followed by 3,078 in 2017 and 149 in 2018.

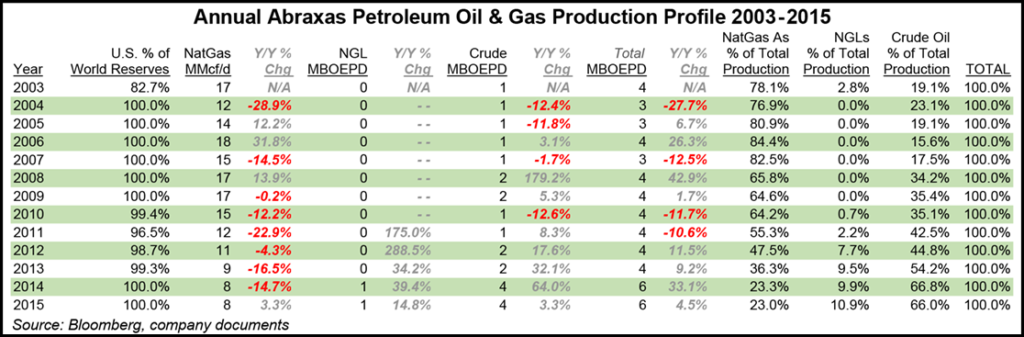

Abraxas reported production fell almost 14% year/year in 4Q2015 to 537,000 boe (5,841 boe/d) from 624,000 boe (6,785 boe/d). For the full-year 2015, production totaled 2.18 million boe (5,975 boe/d), a 4.5% increase over the 2.09 million boe (5,720 boe/d) produced in 2014.

The 10-K also indicated that Abraxas had 615.5 (247.3 net) producing oil wells and 490.5 gross (64.2 net) producing gas wells at the end of 2015. Of those, there were 376.0 gross (81.7 net) oil and 412.0 gross (11.2 net) gas wells in the Rockies; 189.0 gross (126.5 net) oil and 51.0 gross (27.6 net) gas wells in the Permian; and 50.5 gross (39.1 net) oil and 27.5 gross (25.4 net) gas wells in the onshore Gulf.

The company plans to spend between $17.5 million and $40 million on capital expenditures in 2016, compared with $69.4 million in 2015.

Abraxas reported a net loss of $67.4 million (minus 64 cents/diluted share) for 4Q2015, compared to net income of $30.1 million (28 cents) in 4Q2014. For the full-year 2015, the company reported a net loss of $127.1 million (minus $1.21/share), compared with net income of $63.3 million (62 cents) in 2014. Excluding one-time items Abraxas reported an adjusted net loss of $1.9 million (minus 2 cents/share) for 4Q2015 and an adjusted net loss of $6.0 million (minus 6 cents) for 2015. By comparison, the E&P reported adjusted net income of $6.1 million (six cents/share) and $39.8 million (39 cents) in 4Q2014 and the full-year 2014, respectively.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |